This article goes through the pricing updates for NVIDIA's RTX 50 series GPUs, AMD's RX 9070 XT and 9070 GPUs, and Intel's B580 and B570 video cards

The Highlights

- GPU MSRP is still too high in a lot of cases, but it's certainly better than the huge price overhead on top of MSRP back in June

- The rumor is that NVIDIA will stop bundling memory with GPUs to partners, which we worry will result in worse partner pricing for board vendors and higher prices

- GPU pricing has cratered since June and March of this year, and it's just in time for DRAM shortages and VRAM prices to go up

Table of Contents

- AutoTOC

Intro

The GPU Market has been in flux all year. Right when memory prices are skyrocketing, GPUs are finally available near MSRP.

Editor's note: This was originally published on November 20, 2025 as a video. This content has been adapted to written format for this article and is unchanged from the original publication.

Credits

Host, Writing

Steve Burke

Video Editing

Tim Phetdara

Research, Writing

Tannen Williams

Writing, Web Editing

Jimmy Thang

The new rumor is that NVIDIA will no longer bundle memory with GPUs, meaning partners will be on their own to source memory. That’ll almost definitely result in worse pricing for the board partners, ending up with more of an FE advantage while also fully embracing the memory supply impact on VRAM pricing.

Which, of course, is also caused in part by NVIDIA in its thirst for AI.

We talked about the memory side in a separate story, it’s just that VRAM will ultimately be impacted by this, which will impact GPU prices.

Even still, we’re looking at GPU prices as they stand right now to update our GPU pricing series from earlier this year.

Based on the data, people still aren’t buying 8GB GPUs, and the higher end cards are still the worst examples of AVG Price and AVG% over MSRP.

Pricing and availability in the GPU market have noticeably improved since we last collected the data in early June.

Instead of only 13 current gen GPU models available for MSRP, there’s now 58 listings in stock at MSRP. And the number of total in-stock listings increased from 135 to 171. So far, these are good things.

Prices have also improved, with AVG price for in-stock listings decreasing for nearly every current gen GPU.

The 5090 (read our review) was also the only GPU not available for MSRP. It was also the only GPU that increased in AVG price since we collected them last, continuing to demonstrate how NVIDIA’s lack of competition from AMD and Intel in the high-end market segment inevitably leads to consequences for consumers.

So GPU pricing is getting better, generally, but it still has a lot of room for improvement, especially with the higher-tier graphics cards.

Our primary focus will be on the 9070 XT (read our review) since we have the most extensive data for the 9070 XT, and because AMD was so off its MSRP mark at launch.

Overview

In light of the ongoing price surges we’ve seen in the DRAM industry recently, we decided to revisit prices in the GPU market.

We collected prices at a few points over the last few months, including just before Thanksgiving, when prices are in flux more often. We aren’t factoring-in Black Friday sales.

We think our data’s representative of the most stable prices we can expect to see before they’re affected by the incoming DRAM price hikes that’ll soon get passed on to GPU customers through the cost of VRAM.

We’ve already seen rumors that NVIDIA’s 50 series Super launch will be delayed as a result, and AMD seems to be following a similar path.

Found via Dan Nystedt on Twitter: “AMD has notified supply chain partners it will raise graphics card prices 10% across the entire product line due to rising memory chip prices, media report. It will reportedly be AMD’s 2nd such price increase.”

Further, the newest information suggests NVIDIA will stop selling packaged memory with its GPUs, forcing board partners to source their own memory supply -- and it’ll likely be at worse rates than what NVIDIA gets.

Today’s article will be relatively straightforward, especially compared to some of the more in-depth technical pieces we’ve published recently, like our recent Linux GPU benchmarking.

We’ll start by examining how GPU pricing and availability has changed within the 5 and a half months since we last collected prices.

Then, we’ll take a closer look at the 9070 XT’s price history, as that’s currently our most comprehensive dataset for any individual GPUs.

And finally, we’ll wrap up with any additional observations, some extra charts we put together when trying to figure out the best ways to visualize the data, and our general outlook on the current state of the new GPU market.

But before getting into any of the data, we first need to define our methodology.

Methodology

The last time we collected GPU prices in June, we used listings from Newegg, Amazon, and Micro Center, but we’ve excluded Amazon and Micro Center listings today, instead relying only on Newegg first-party listings. Our primary reasoning for this is that Newegg has been more price-stable than Amazon, while Micro Center often integrates bundles that affect price in ways that are difficult to account for (and often in-person only). Amazon gets flooded with third-party listings that complicate things, while Newegg has the most first-party shipped & sold listings for us to work with.

We’re also working with only in-stock listings. This approach isn’t perfect and average prices will lean higher because typically GPUs sell out of their cheapest models first.

Remember also that we don’t have the actual inventory unit counts for any of the GPU models we’ll be going over today. We can use the number of models a certain GPU has in stock to draw inferences from, but that obviously doesn’t tell us the quantity of cards.

Getting into the results:

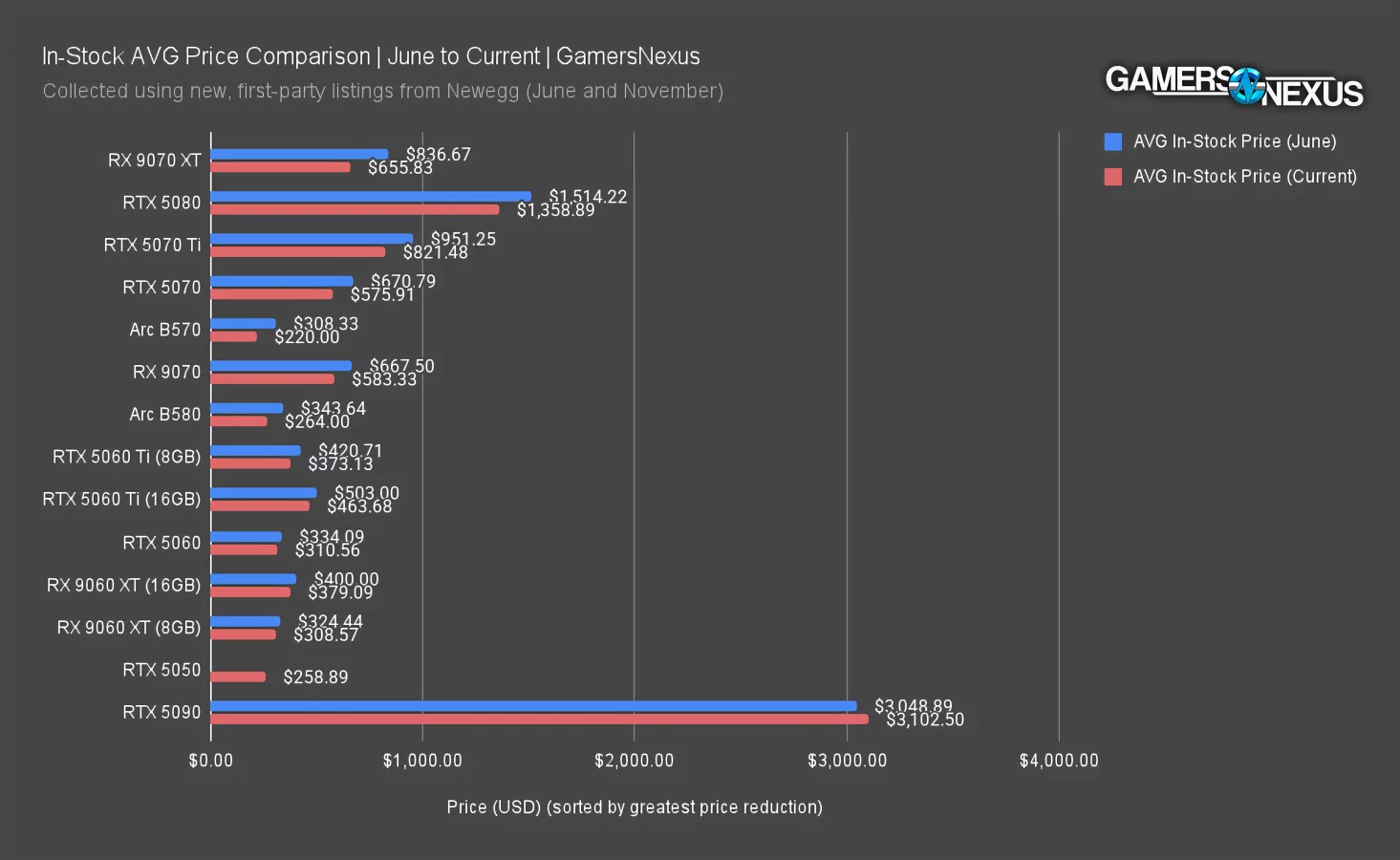

Our first charts will take a look at how AVG prices for in-stock listings have changed since we last collected the data in early June.

We also understand that other regions have different prices. For this piece, we’re focusing on the market we know the best.

In-Stock AVG Price Comparison | June to Current | GamersNexus

Compared to our June check-in, all current generation graphics cards had at least some price drop – except for the 5090.

The largest price reductions since June come from the RX 9070 XT, RTX 5080, and 5070 Ti. The 9070 XT dropped from $837 in June to about $655, or over 20%, with the $600 MSRP a further 8% below the average. $837 in June is absolutely insane for this video card.

Since June, the 5080’s in-stock AVG decreased by $155, or 10%, to its $1,360 in-stock AVG now. The 5070 Ti followed similarly: Its in-stock AVG decreased by $130, or 14%, to its current in-stock AVG of $820.

The 5060 Ti (read our review), 5060 (read our review), and 9060 XT (read our review) are the cheapest and started closer to MSRP, so it makes sense that they were least impacted in terms of absolute reductions to their in-stock AVG prices. They saw reductions from $15 - $50.

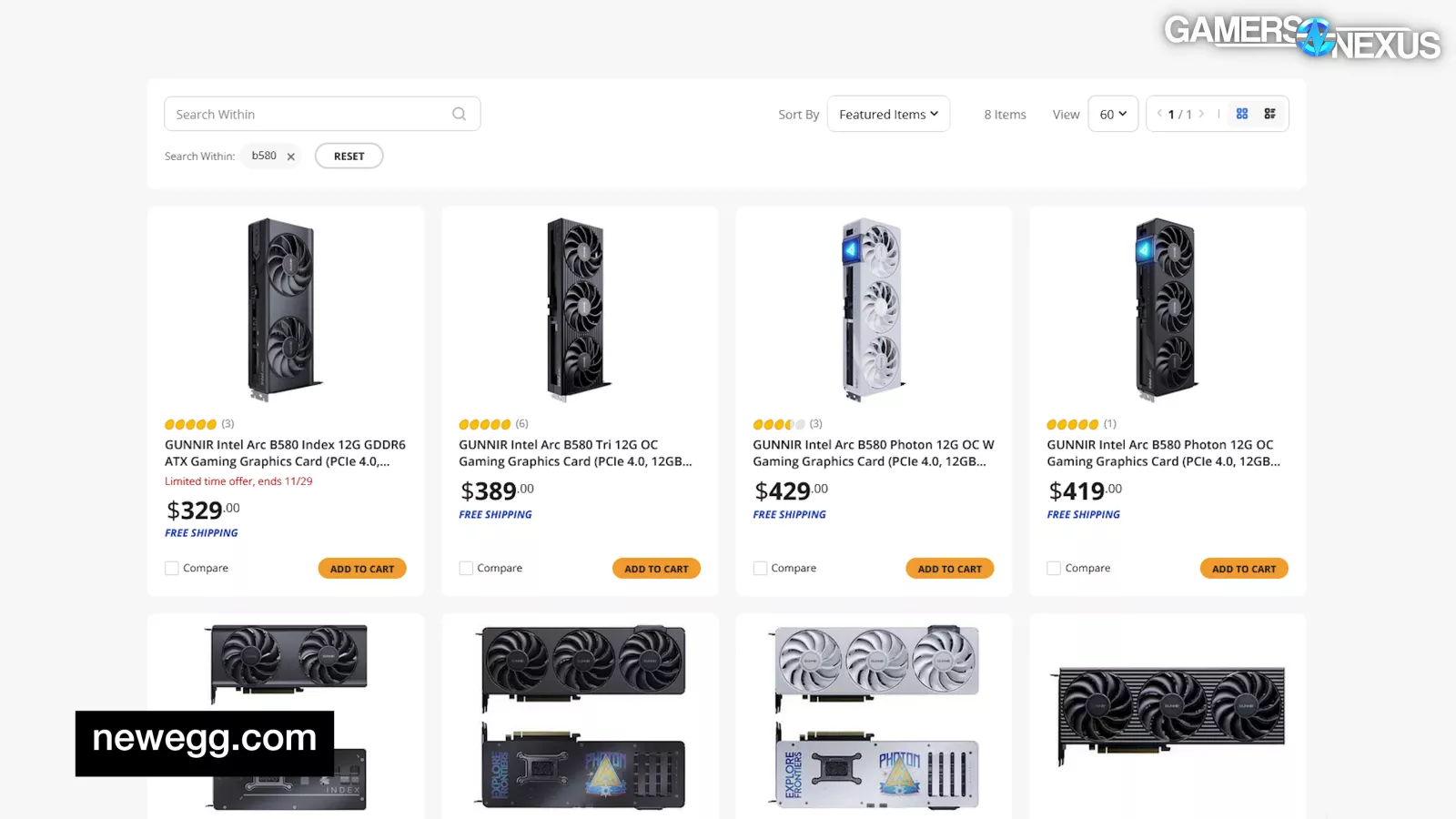

Intel has improved dramatically, dropping from $344 on average to $264 for the B580 GPU. The B570 dropped from $308 to its $220 MSRP. These are significant changes by percentage, at 23% reduction for the B580 and 29% reduced price for the B570.

The RTX 5090 was the only card to increase in price, with an AVG $50 greater than it was in June. Considering it doesn’t have competition, this price stability makes sense, but it’s obviously discouraging to see an increase. The 5090 will also be the most impacted by VRAM prices due to its capacity, so without price suppression from NVIDIA’s direct sourcing, it could climb the most.

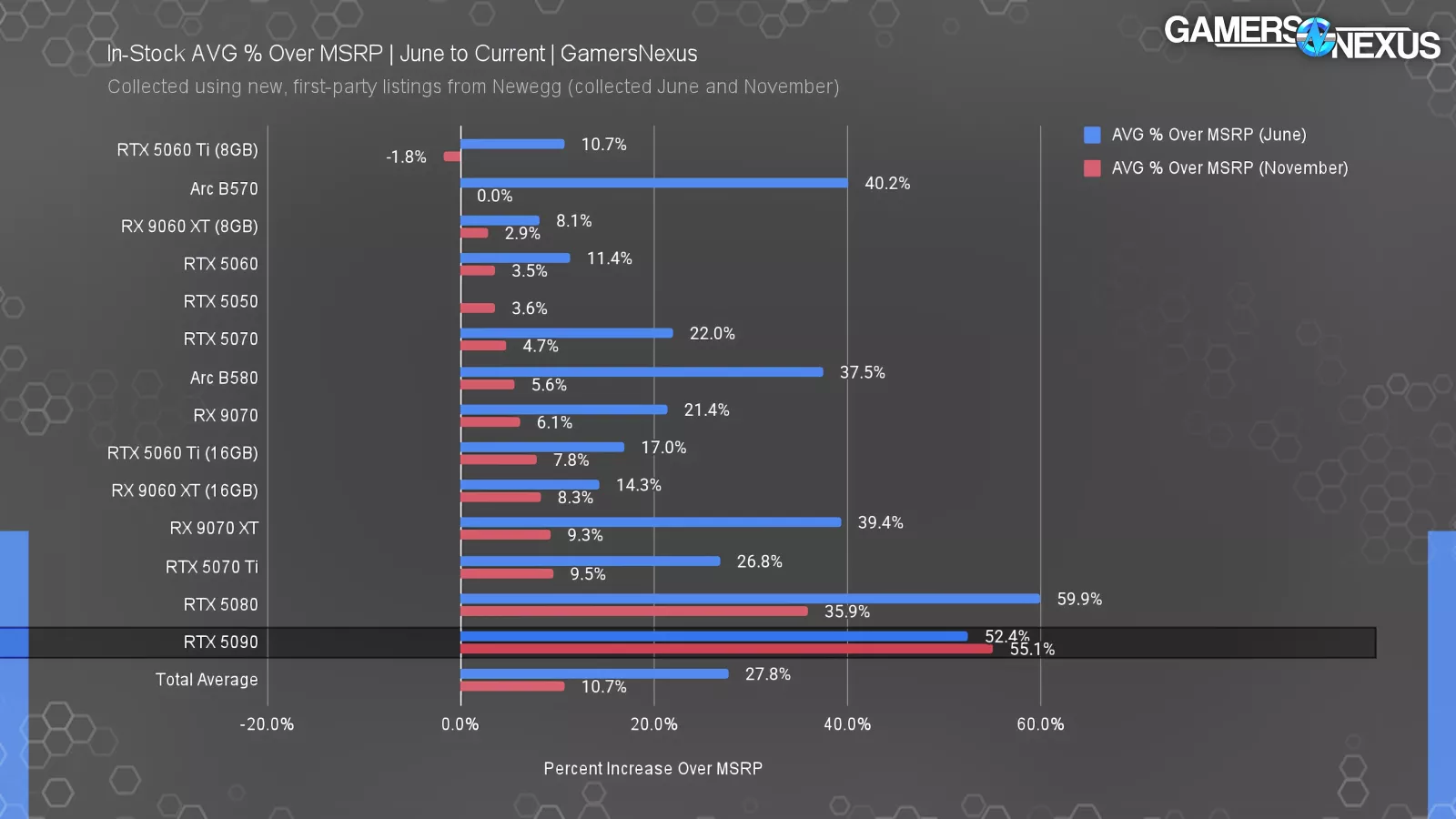

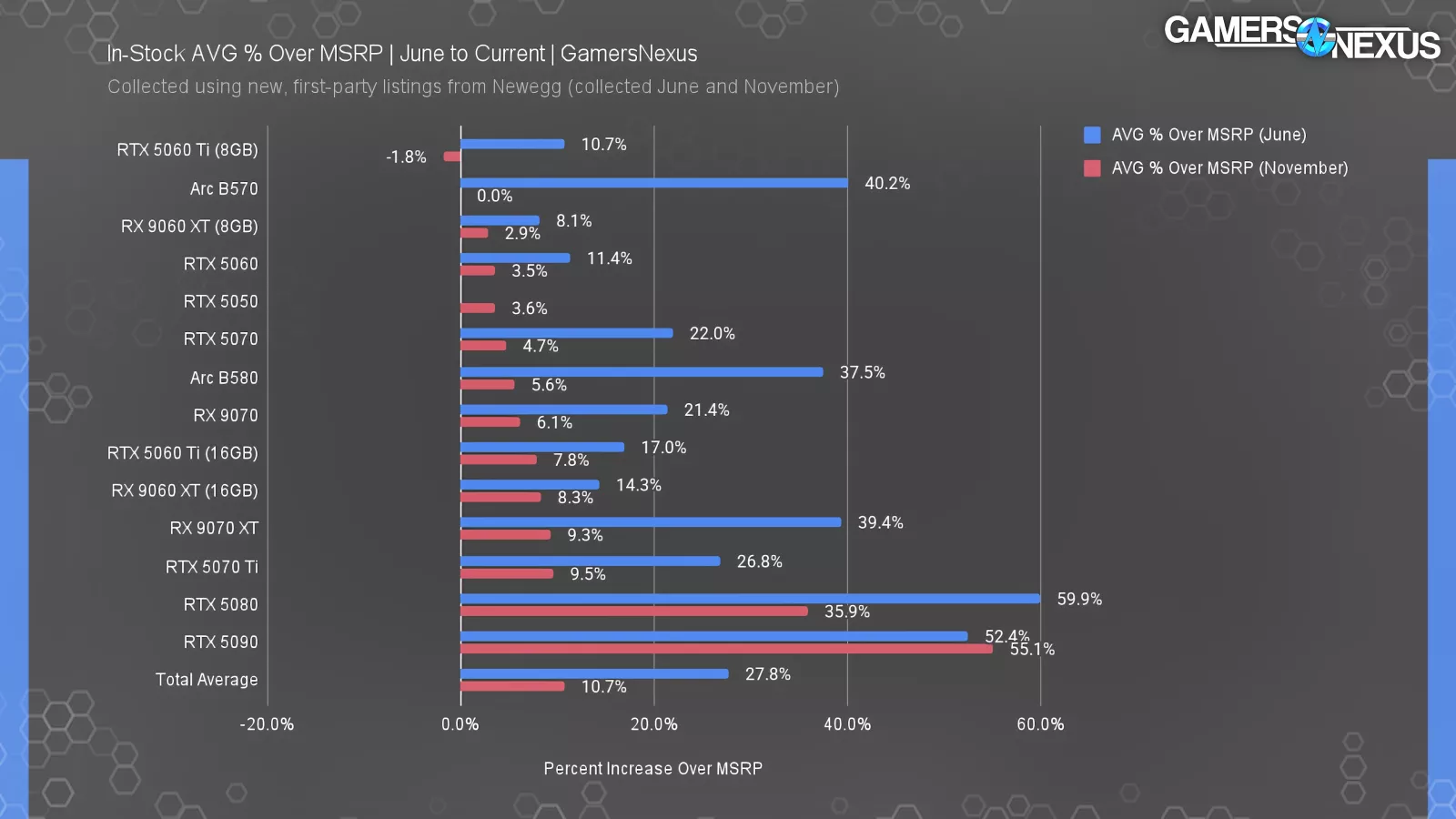

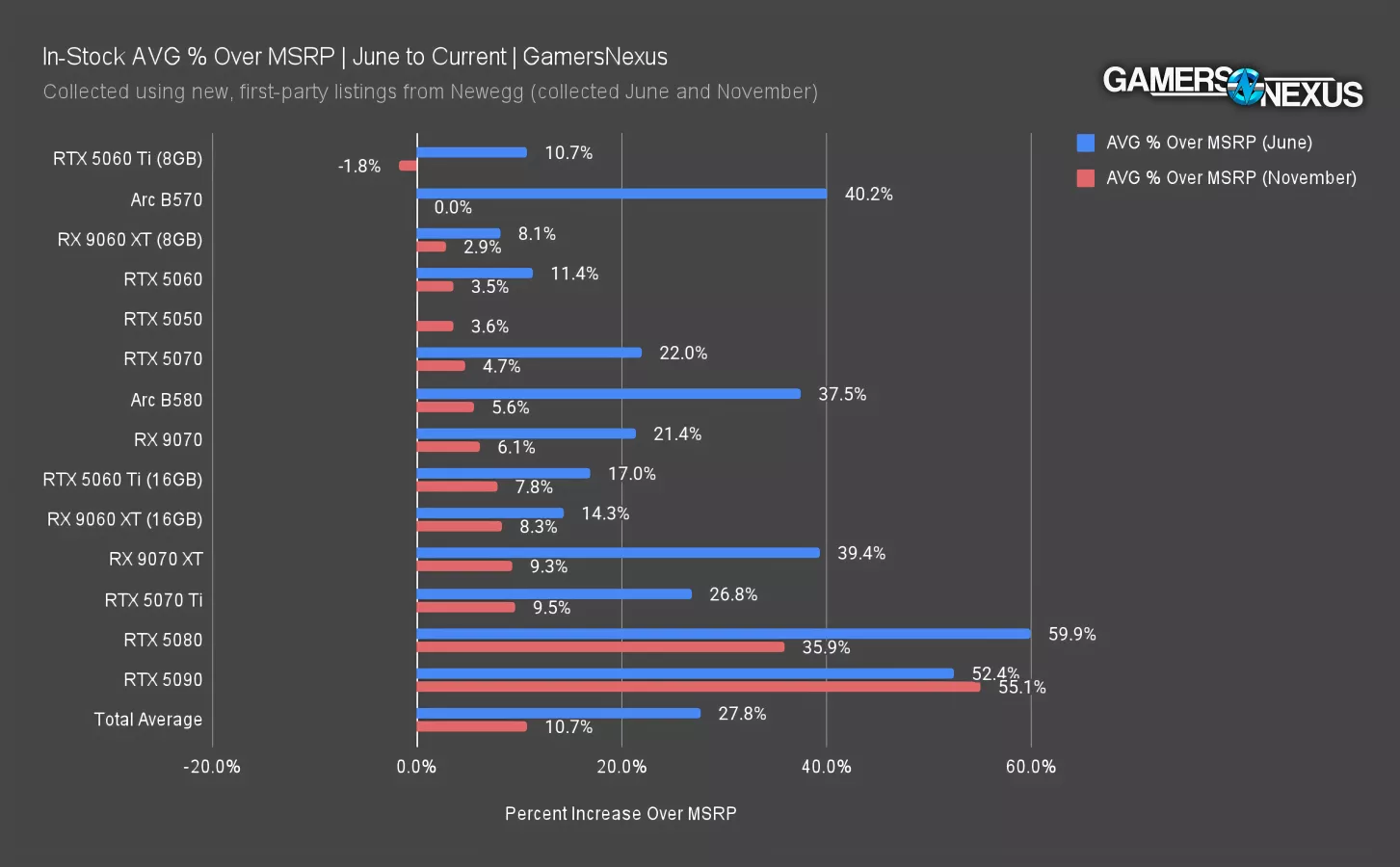

In-Stock AVG % Over MSRP | June to Current | GamersNexus

Using only in-stock listings, this chart shows the average price percent over MSRP baseline.

The Arc B570 (read our review) and B580 (read our review) GPUs had outlier overages beyond MSRP previously and stand out as having the greatest return to normal pricing.

We dug into this further and found these reductions were most notably caused by Weeliao’s Battlemage cards disappearing from listings. These were previously the most expensive listings offered for Arc models and, since Arc has so few models available, they were often among the few in stock.

MSRP for the 5060 Ti 8GB is currently higher than the retail price by a thin percentage, aligning with the fact that these are still having the most trouble selling to DIY enthusiasts. That’s probably of no concern to NVIDIA though, since SIs and OEMs will still be able to use them to mislead customers.

The 9060 XT 8GB is in a similar situation, at 2.9% over MSRP now for 8GB. The 16GB models for these cards are at 7.8% and about 8.3% over MSRP. The 5060 non-Ti is also close to baseline, at 3.5% over on average.

Some overhead past MSRP is normal, as partner models always include boards with quality of life features (like better acoustics or thermals) that may warrant a higher price within reason. These percentages are reasonable.

Looking at the data as a whole: The combined AVG % over MSRP for all in-stock GPUs collectively has decreased from 27.8% over MSRP in June to 10.7% currently.

In any case, broadly speaking, prices are getting better. There’s still a lot to be desired, but we're optimistic that things are at least moving in the right direction and we are pessimistic that this will soon stop.

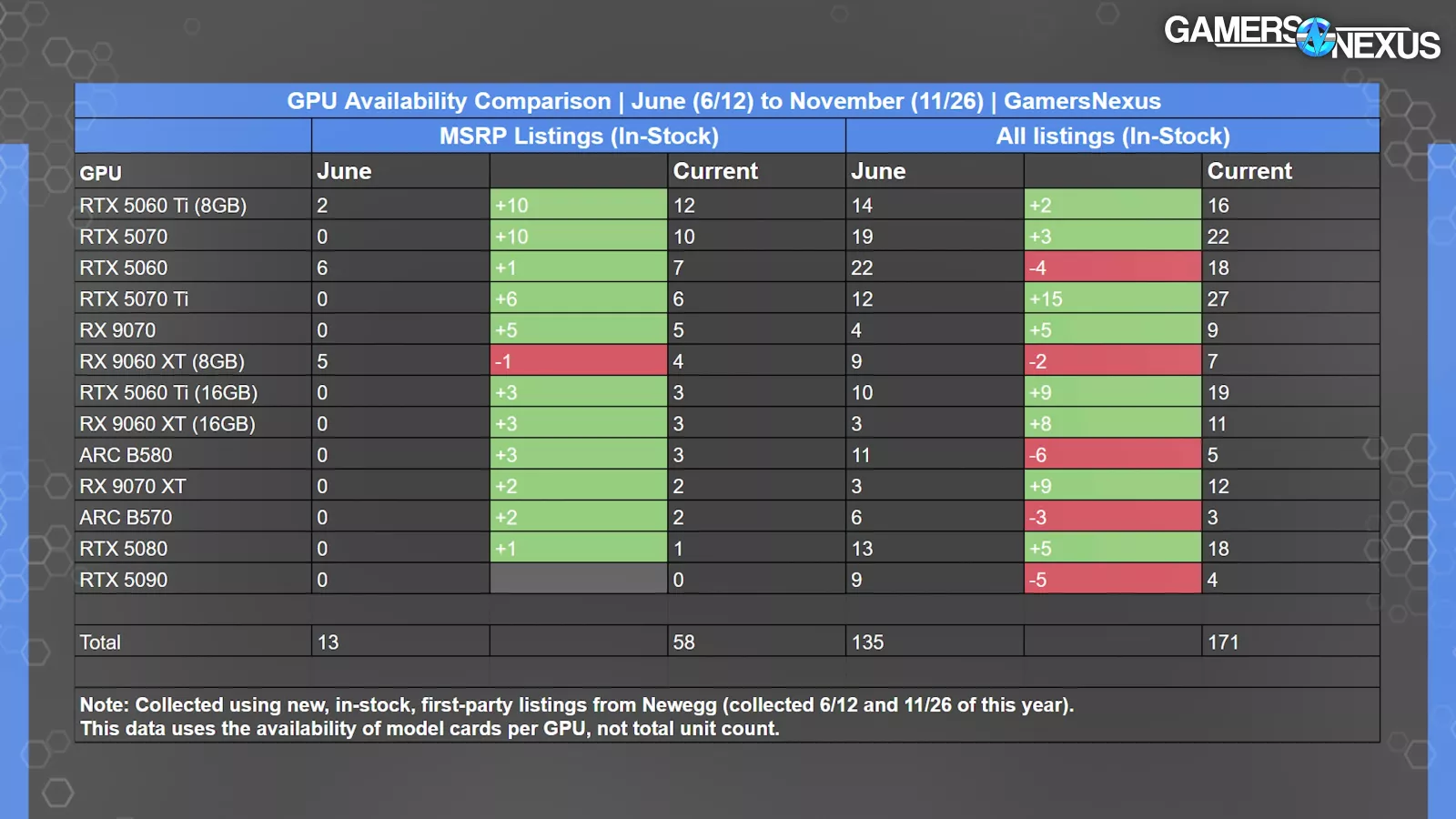

GPU Availability Comparison | June to Current | GamersNexus

GPU Availability Comparison | June (6/12) to November (11/26) | GamersNexus

| MSRP Listings (In-Stock) | All listings (In-Stock) | |||||

| GPU | June | Current | June | Current | ||

| RTX 5060 Ti (8GB) | 2 | +10 | 12 | 14 | +2 | 16 |

| RTX 5060 | 6 | +1 | 7 | 22 | -4 | 18 |

| RTX 5070 | 0 | +10 | 10 | 19 | +3 | 22 |

| RX 9060 XT (8GB) | 5 | -1 | 4 | 9 | -2 | 7 |

| RTX 5060 Ti (16GB) | 0 | +3 | 3 | 10 | +9 | 19 |

| RTX 5070 Ti | 0 | +6 | 6 | 12 | +15 | 27 |

| RTX 5080 | 0 | +1 | 1 | 13 | +5 | 18 |

| ARC B580 | 0 | +3 | 3 | 11 | -6 | 5 |

| ARC B570 | 0 | +2 | 2 | 6 | -3 | 3 |

| RX 9060 XT (16GB) | 0 | +3 | 3 | 3 | +8 | 11 |

| RX 9070 | 0 | +5 | 5 | 4 | +5 | 9 |

| RTX 5090 | 0 | 0 | 9 | -5 | 4 | |

| RX 9070 XT | 0 | 2 | 3 | +9 | 12 | |

| SUM | 13 | 58 | 135 | 171 |

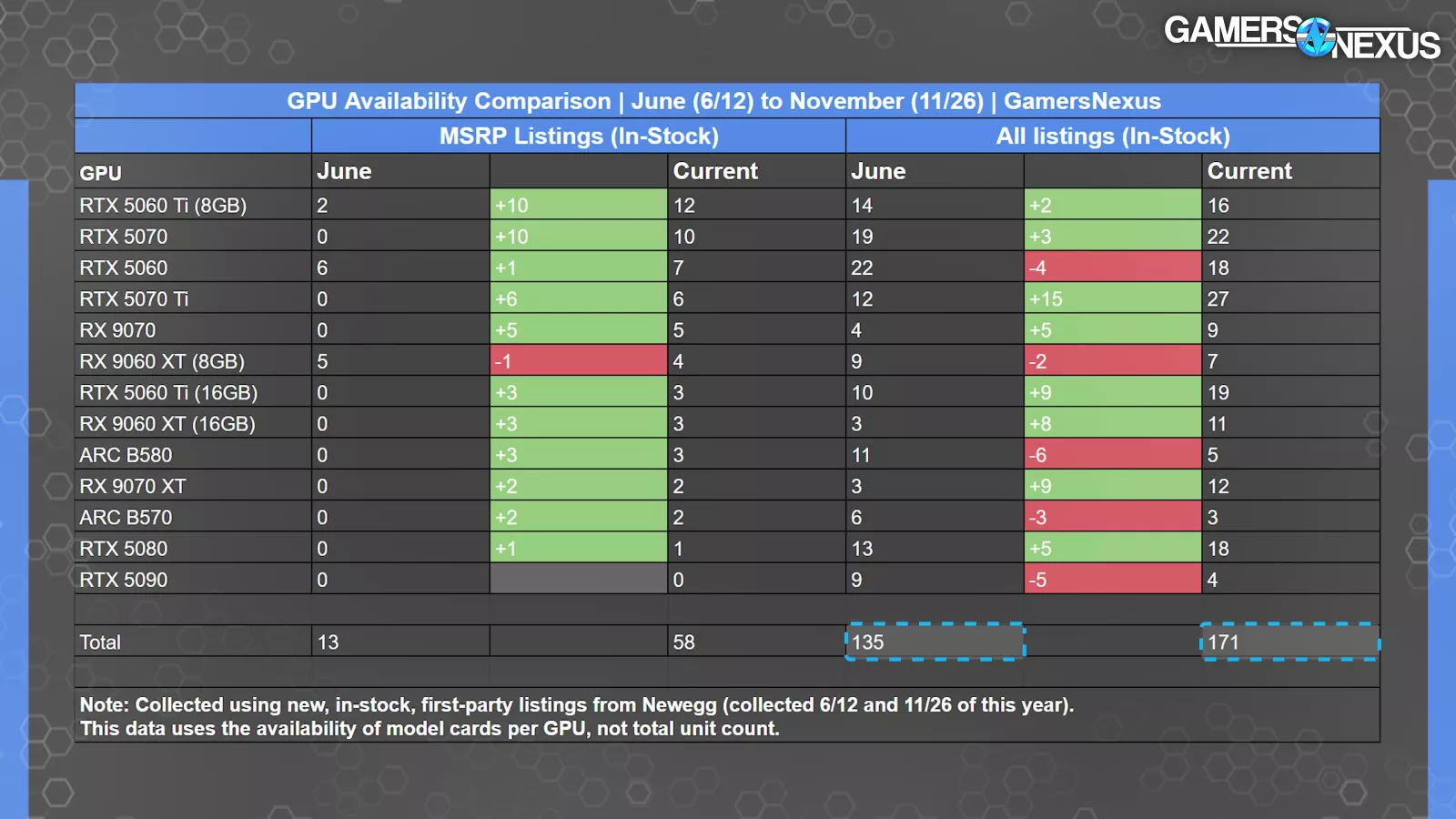

This table shows how the number of total and MSRP listings in stock for each current generation graphics card has changed from June to the present.

Total in-stock listing count increased by 26.7%, from 135 to 171 model GPUs since June, with in-stock MSRP listings up 346.2% to 58, from 13 previously. This is heavily contingent on when stock is checked, obviously, and we don’t know the total volume difference, but that will align with the total volume difference.

Intel’s Arc B580 and B570 both saw reductions to their in-stock listing total due to Weeliao’s removed Newegg listings, which we think is a good thing and was for the best. The 5090 also had a noticeable decrease in listings, down from 9 in June to only 4 at the time of data compilation.

GPUs that saw the greatest increases to in-stock listings include the RTX 5070 Ti (read our review) at 27 from 12, then the 9070 XT, and 16GB 5060 Ti and 9060 XT, each with 8 to 9 more in-stock models than previously.

The 5070 (read our review) and 8GB 5060 Ti each gained 10 in-stock MSRP cards, for the greatest improvements in this category. That’s good to see at least, although the 8GB 5060 Ti is probably because no one wants it.

At the time of writing this, all current gen GPUs, excluding the 5090, are available for MSRP, up from 3 of 13 GPUs previously. We won’t adjust this after writing even if it changes, as it is important methodologically to lock-in the comparison at a fixed timestamp for every device.

Overall, GPU availability has definitely improved since June.

Moving on to the 9070 XT’s troubled pricing history:

9070 XT Price History

9070 XT Newegg Price History | March (3/7) to June (6/12) to November (11/26) | GamersNexus

| Card Model | Launch Prices | June Prices | November Prices | June Stock | November Stock |

| ASRock Challenger | $600 | Yes | |||

| ASRock RX 9070 XT Steel Legend | $600 | $700 | $620 | No | Yes |

| ASRock RX 9070 XT Taichi | $730 | $850 | $680 | No | Yes |

| ASRock Steel Legend Black | |||||

| ASUS PRIME | $600 | $600 | No | No | |

| ASUS RX 9070 XT Prime OC | $720 | $720 | $650 | No | Yes |

| ASUS RX 9070 XT TUF OC | $800 | $800 | No | ||

| Gigabyte RX 9070 XT AORUS ELITE | $760 | $760 | No | ||

| Gigabyte RX 9070 XT Gaming | $600 | $660 | No | ||

| Gigabyte RX 9070 XT Gaming OC | $730 | $730 | $700 | No | Yes |

| PowerColor RX 9070 XT Hellhound | $760 | $720 | No | ||

| PowerColor RX 9070 XT Reaper | $600 | $600 | Yes | ||

| PowerColor RX 9070 XT Red Devil | $800 | ||||

| Sapphire RX 9070 XT NITRO+ | $780 | $850 | $700 | Yes | Yes |

| Sapphire RX 9070 XT Pulse | $600 | $800 | $650 | Yes | Yes |

| Sapphire RX 9070 XT PURE | $740 | ||||

| XFX RX 9070 XT Mercury Magnetic Air OC (White) | $850 | ||||

| XFX RX 9070 XT Mercury OC | $850 | $900 | $720 | No | Yes |

| XFX RX 9070 XT Mercury OC (White) | $820 | ||||

| XFX RX 9070 XT Quicksilver | $750 | $860 | $680 | Yes | Yes |

| XFX RX 9070 XT Quicksilver (White) | $770 | $880 | No | ||

| XFX RX 9070 XT Swift | $730 | $840 | No | ||

| XFX RX 9070 XT Swift (White) | $600 | $850 | No | ||

| ASRock Monster Hunter Edition | $650 | Yes | |||

| Gigabyte Gaming OC ICE | $720 | Yes | |||

| AVGs (ALL listings) | $729 | $787 | $660 | 3/15 | 12/14 |

This table compiles all 9070 XT listings we’ve pulled from Newegg since the GPU’s launch, with AVGs inclusive of all models and prices collected in March, June, and November of this year.

During its release, the 9070 XT’s AVG price was $729, or 21.5% over MSRP.

From launch to June, AVG price increased to $787, or 31.2% over MSRP. Things got worse, making AMD’s MSRP promise, in our eyes, a flat-out lie.

Since then, the 9070 XT’s AVG decreased, resulting in an all-time low AVG of $660, or 10% over MSRP currently. That’s down from 31% over in June.

The 9070 XT’s availability also considerably improved since this summer, growing from 3/15 to 12/14 listings in-stock.

Unfortunately, this isn’t a perfect comparison because the models listed on Newegg changed each time we collected the results, as indicated by gaps in our table.

That’s why we made this one:

9070 XT Price History (Narrowed)

9070 XT Newegg Price History | March (3/7) to June (6/12) to Current (11/26) | GamersNexus

| Card Model | Launch Prices | June Prices | October Prices | June Stock | October Stock |

| ASRock RX 9070 XT Steel Legend | $600 | $700 | $620 | No | Yes |

| ASRock RX 9070 XT Taichi | $730 | $850 | $680 | No | Yes |

| ASUS RX 9070 XT Prime OC | $720 | $720 | $650 | No | Yes |

| Gigabyte RX 9070 XT Gaming OC | $730 | $730 | $700 | No | Yes |

| Sapphire RX 9070 XT NITRO+ | $780 | $850 | $700 | Yes | Yes |

| Sapphire RX 9070 XT Pulse | $600 | $800 | $650 | Yes | Yes |

| XFX RX 9070 XT Mercury OC | $850 | $900 | $720 | No | Yes |

| XFX RX 9070 XT Quicksilver | $750 | $860 | $680 | Yes | Yes |

| AVGs (ALL listings) | $720 | $801 | $675 | 3/8 | 8/8 |

In this table, we’ve narrowed our results to only include the 8 specific 9070 XT models that remained listed throughout each of our data captures. Naturally, the results seen here largely correspond with those from the previous table.

Each listing’s price increased or didn’t change from launch to June and then decreased in the time from June to now, with AVGs of $720 initially, $801 this summer, and $675 currently.

Generally speaking, aside from the summer spike, this aligns with how pricing typically changes over time -- especially for AMD GPUs that tend to launch a little too close to NVIDIA pricing.

AVG price being currently lower than it was at launch is promising, but we only saw one 9070 XT model at MSRP at the time of data compilation.

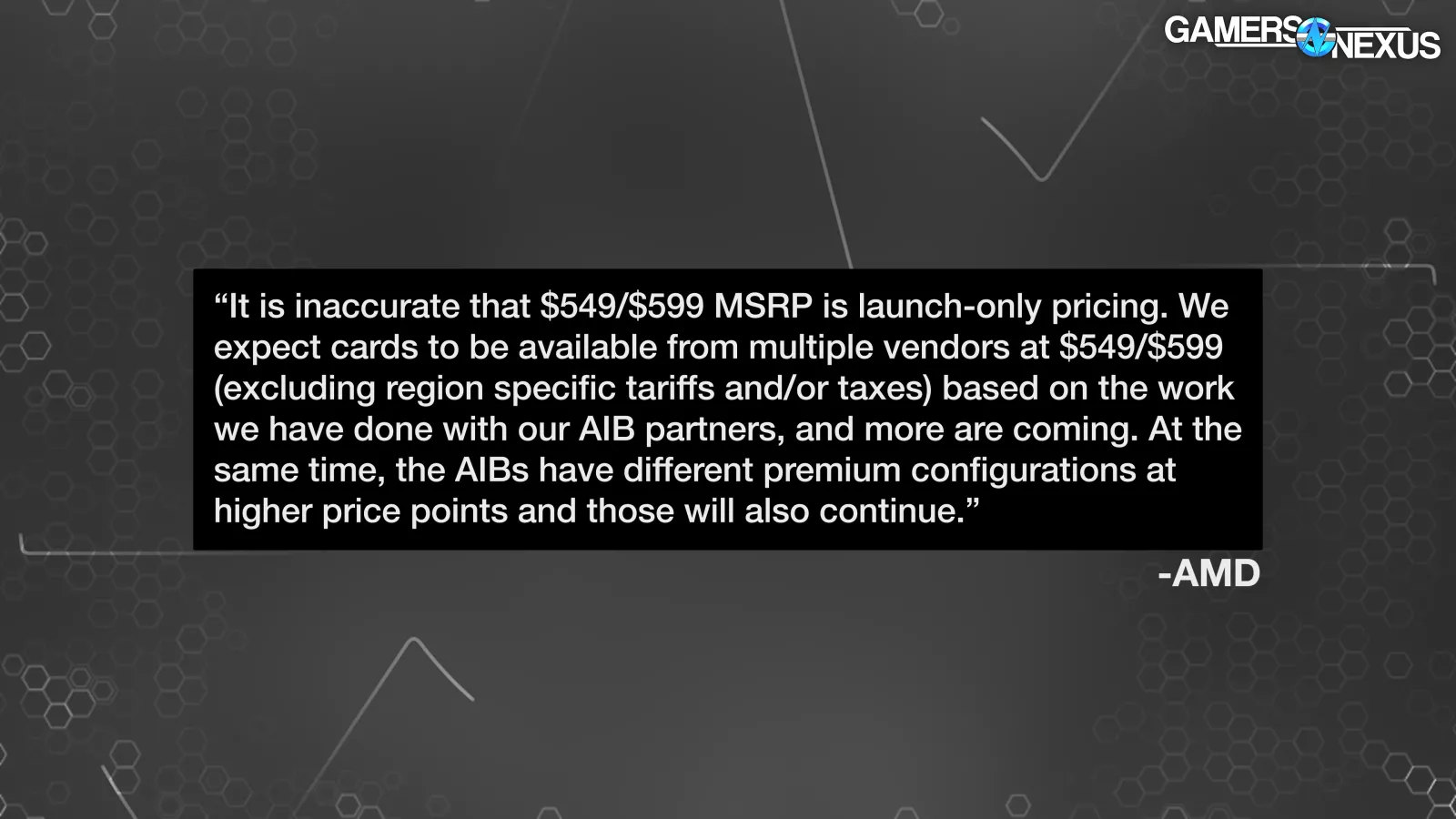

We’d like to see more from AMD on this front, especially considering the company’s extremely defensive claims about it being inaccurate to call the 9070 XT’s MSRP a launch-only pricing. AMD is twisting reality with its prior statement and has now been objectively proven to be false, making them, in our opinions, either liars or manipulators, if not both. They would have done better to keep their mouths shut.

Now, moving on to some of our less conclusive findings:

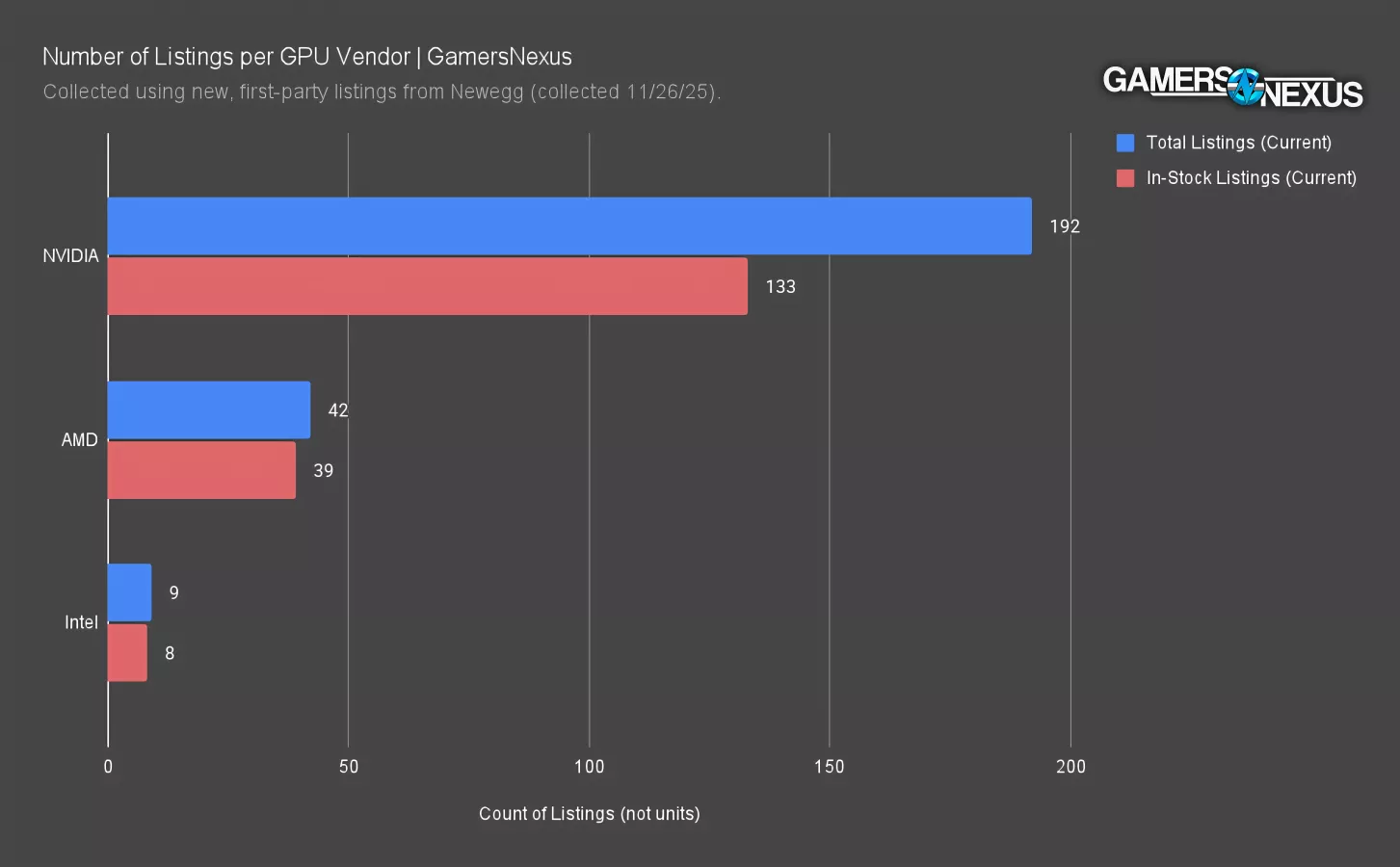

Number of Listings per GPU vendor

This chart represents the total and in-stock listing count for each GPU vendor’s current series GPUs on Newegg.

Out of the 243 total current gen Newegg listings, 192, or 79%, were provided by NVIDIA. NVIDIA is claimed to have around 90-94% of GPU marketshare, so this somewhat aligns with that.

Of NVIDIA’s 192 listings, 133, or 72.7%, were in stock.

AMD partners provided 42, or 17.3%, of Newegg’s current GPU listings, with 39 out of its 42 in stock (meaning 93% in-stock).

Intel partners supplied nine GPU models, making up just under 4% of all current gen Newegg listings, with nearly 90% of its models in-stock.

Obviously, we’d like to see more competition from AMD and Intel here. Both companies have a lot of work to do if they ever hope to challenge NVIDIA’s dominance over the GPU market in any meaningful way. There’s a game here of flooding the shelves just to be the most present by volume, which helps with consumer perception but also just the odds of someone clicking on your model. It’s a chicken-or-egg problem for the non-NVIDIA, though, because without more market share, it’s hard to justify more model GPUs.

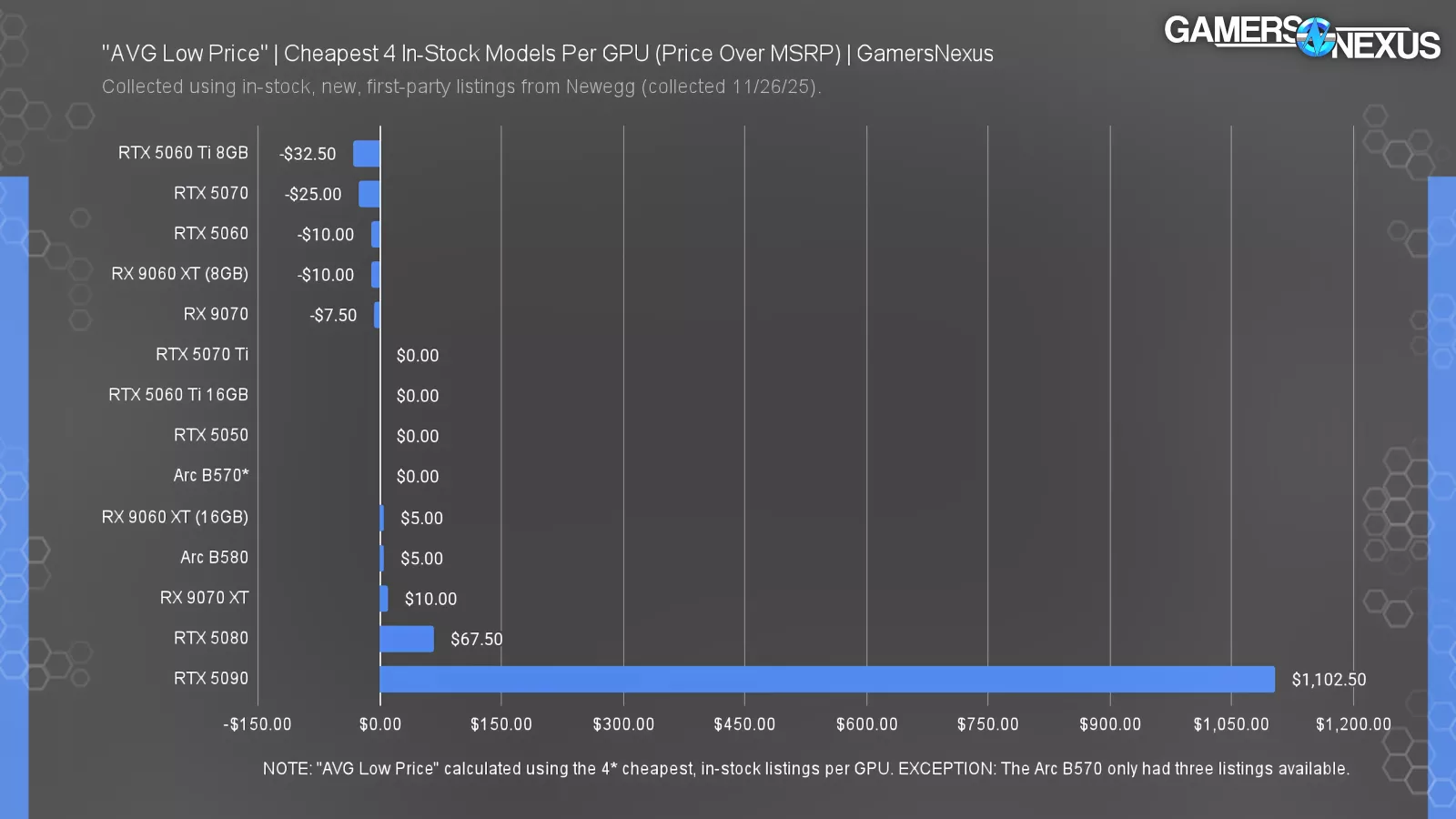

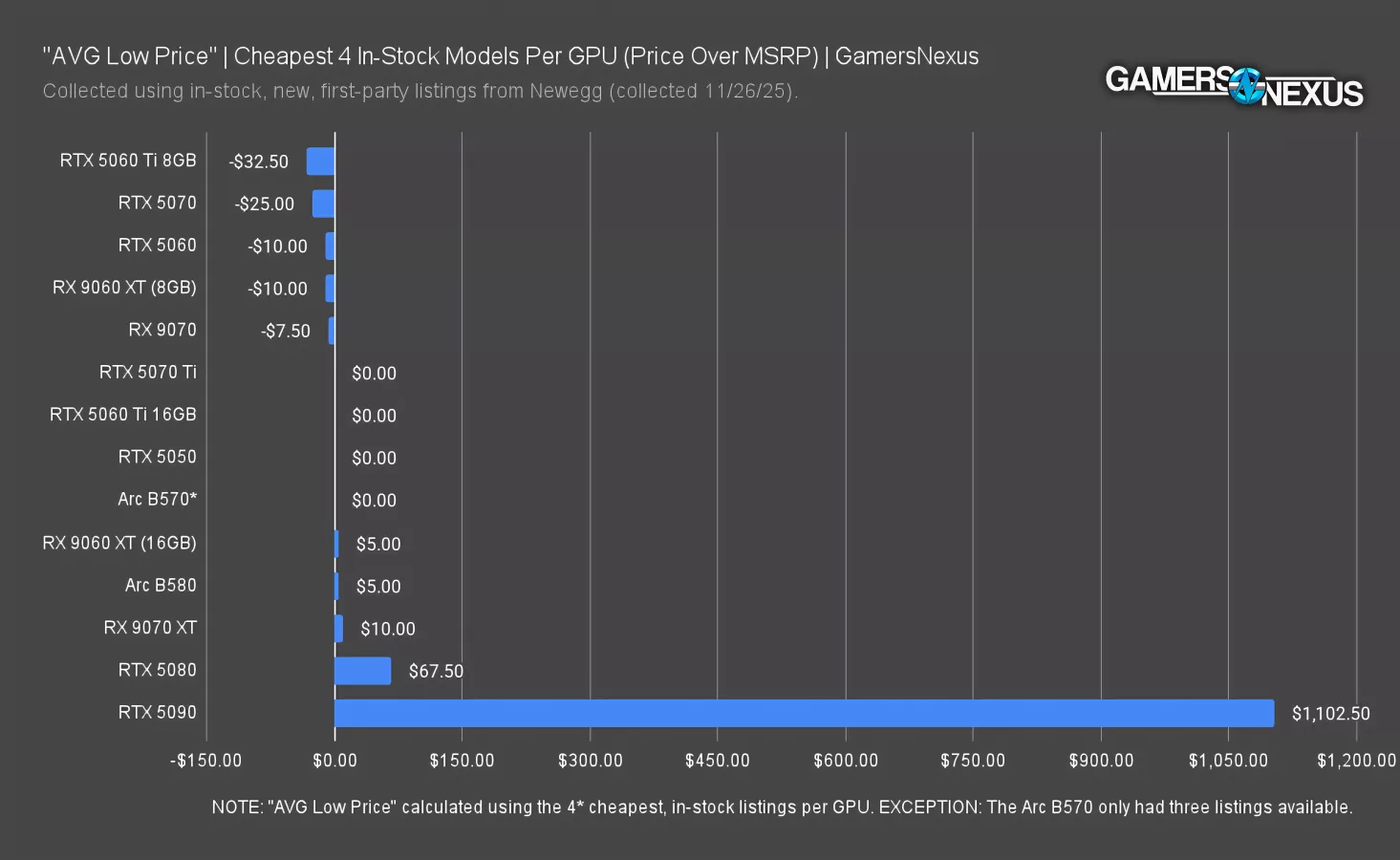

“AVG Low Price” - MSRP

This chart explores a different approach for a metric that’s representative of around the cheapest price you could realistically find any of these new GPUs for. We wanted to eliminate overpriced partner models.

We came up with what we’re calling “AVG Low Price,” calculated using each GPU’s 4 cheapest, in-stock, first-party listings. This is particularly useful for excluding each GPU’s most overpriced models.

This chart illustrates the difference between each GPU’s “AVG Low Price” and its MSRP.

“AVG Low Prices” for the 5060 Ti 8GB, RTX 5070, RTX 5060, 9060 XT 8GB, and RX 9070 (read our review) were all below their MSRPs, ranging between $7.50 and $32.50 less.

Continuing down the chart, we noticed that the majority of current gen GPUs had “AVG low prices” basically equal to MSRP. This is a strong indicator that prices are gradually getting better, generally speaking. It’s just unfortunate as this is likely temporary due to the memory situation.

Finally, taking the cake as the most egregious example on the chart: The RTX 5090’s “AVG Low Price” was $1,100 over its $2,000 MSRP, again highlighting NVIDIA’s lack of competition in the high-end.

Conclusion

Our conclusion today is simple: As a whole, the GPU market, from a pricing standpoint, looks better now than it did when we collected prices in June, at least for the time being.

In-stock AVG price has decreased for all but one current series GPU on Newegg.

Count of in-stock listings rose from 135 to 171, and those available for MSRP increased from 13 to 58.

Previously, the 5060, 8GB 5060 Ti, and 8GB 9060 XT were the only new GPUs available for MSRP on Newegg. At the time of writing this, all current series GPUs have MSRP listings in-stock except for the and 5090.

Unfortunately, the 5090 was largely unaffected by the market’s improvements and continues to stand out in terms of the most abysmal price hikes over MSRP.

We may check back in a few more months specifically to look for any meaningful price reductions to the 5090, but we generally feel like these are the most stable prices we’ll see in the GPU market before the DRAM price increases start getting passed along to the consumer.