We explore why RAM prices have gone up, the impact to NAND, the impending impact to GPU VRAM prices, and how there's nothing any of us can do

The Highlights

- We collect RAM price data so you can make purchasing decisions

- RAM price increases are for a number of reasons, including AI server demand chewing through supply, previous oversupply leading to a draw-down in manufacturing (which has now caught-up), and probably also RAM companies being a-holes

- Memory prices have skyrocketed over the last several months

Table of Contents

- AutoTOC

Intro

DRAM prices are skyrocketing right now.

Editor's note: This was originally published on November 16, 2025 as a video. This content has been adapted to written format for this article and is unchanged from the original publication.

Credits

Host, Writing

Steve Burke

Video Editing

Vitalii Makhnovets

Andrew Coleman

Writing, Research

Tannen Williams

Writing, Web Editing

Jimmy Thang

In some of our price checks today, we found memory kits increasing by 169%, 116%, 181%, and similar. By hard dollar amount, some of these have gone up by 100s of dollars for a kit of 32GBs in a span of just one to two months. Higher capacities have gone up by $400 or $500 in some cases. At one point, we observed a 1% increase per day for 13 days. There’s even new reports that these recent price increases are to blame for NVIDIA’s potentially delayed unannounced Super Series refresh with worries that the company will prioritize denser GDDR7 modules for workstation GPUs.

Prices are skyrocketing due to a combination of things. These include data center demand, suppliers understocking due to previous oversupply, and other factors that we’ll explore. NAND Flash for SSDs will also likely go up more soon as enterprise demand ramps.

The server demand is fundamentally altering the traditional nature of the market, which means that the DRAM industry is exiting the roughly four-year cycle of memory pricing and remaining elevated for longer than typical.

For example, in OpenAI’s partnership announcement with Samsung and SK Hynix as part of its “Stargate” project, the company stated it was “targeting 900,000 wafer starts per month.” Tom’s Hardware reported that this “represents around 40% of the total DRAM output” globally.

Suppliers have also begun diverting supply resources away from desktop and towards higher margin HBM and server memory instead.

Today, we’re going over memory prices and walking through some of the explanations for their meteoric rise.

If you’re wondering if there’s anything you can do with this information, the answer is no. We’re going to be upfront about that. You can’t do anything with this information. The most you could do is maybe make a decision on when you want to buy, if at all.

Overview

In this article, we’ll start by comparing how desktop DDR4 and DDR5 prices have changed in the past few months, using both current listings and DRAM spot prices. DDR4 prices are unbelievably bad in terms of price increases because you’re getting hit from two sides. 1 is due to the supply going EOL and the other is simply because it’s expensive.

Then, we’ll dig into the memory market’s conditions leading up to this point and attempt to dissect the different factors that have contributed to the current situation.

Finally, we’ll go over the DRAM industry’s 2026 forecast before wrapping up with what we consider the best RAM kits available for consumers currently.

Getting right into the price comparisons:

Price Increases: DDR5-6000

We’ll start with a DDR5 price check. For this, we need to pick kits that have relatively reliable availability to make sure the prices aren’t too impacted by simply being low stock at the retailer.

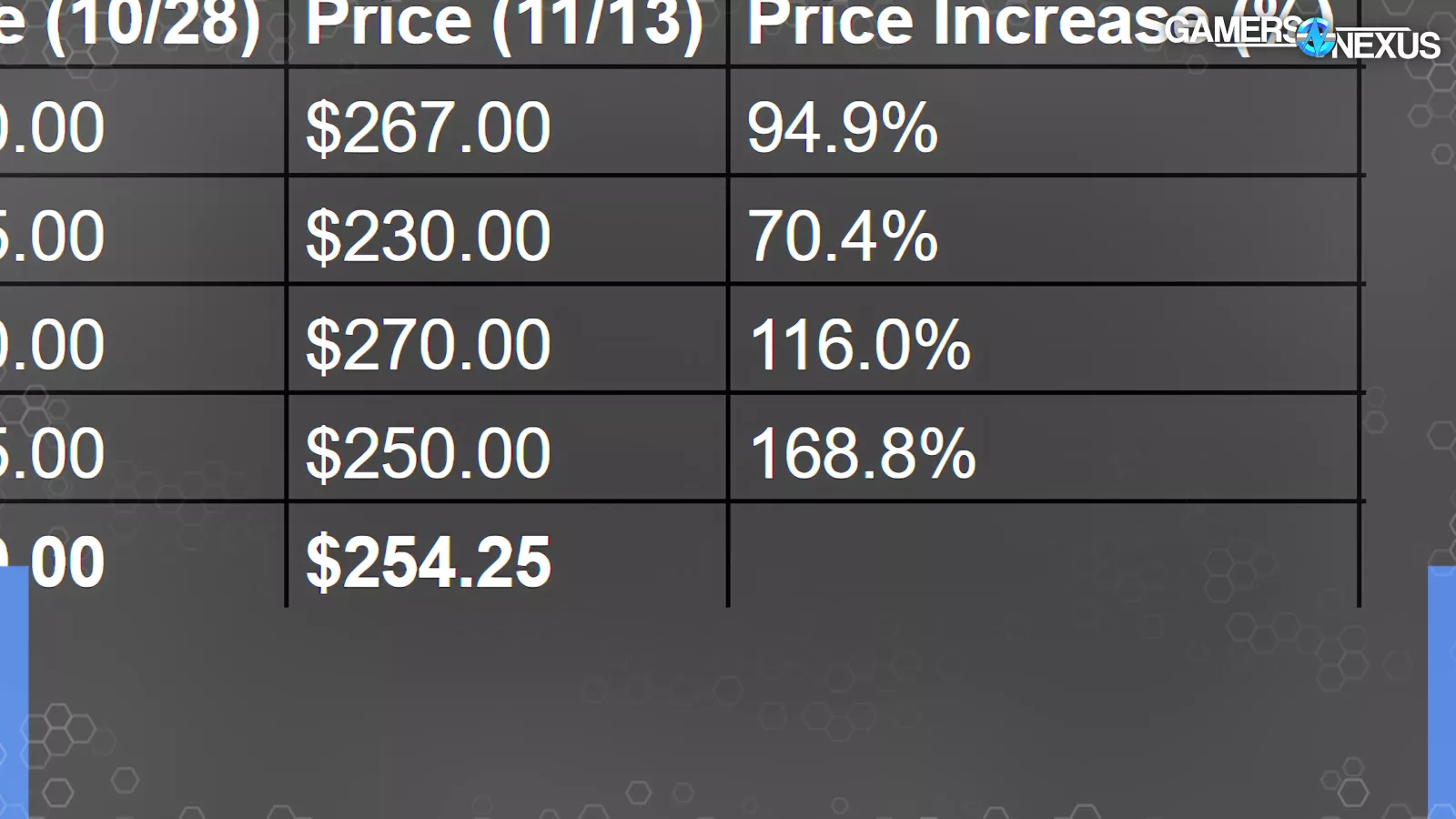

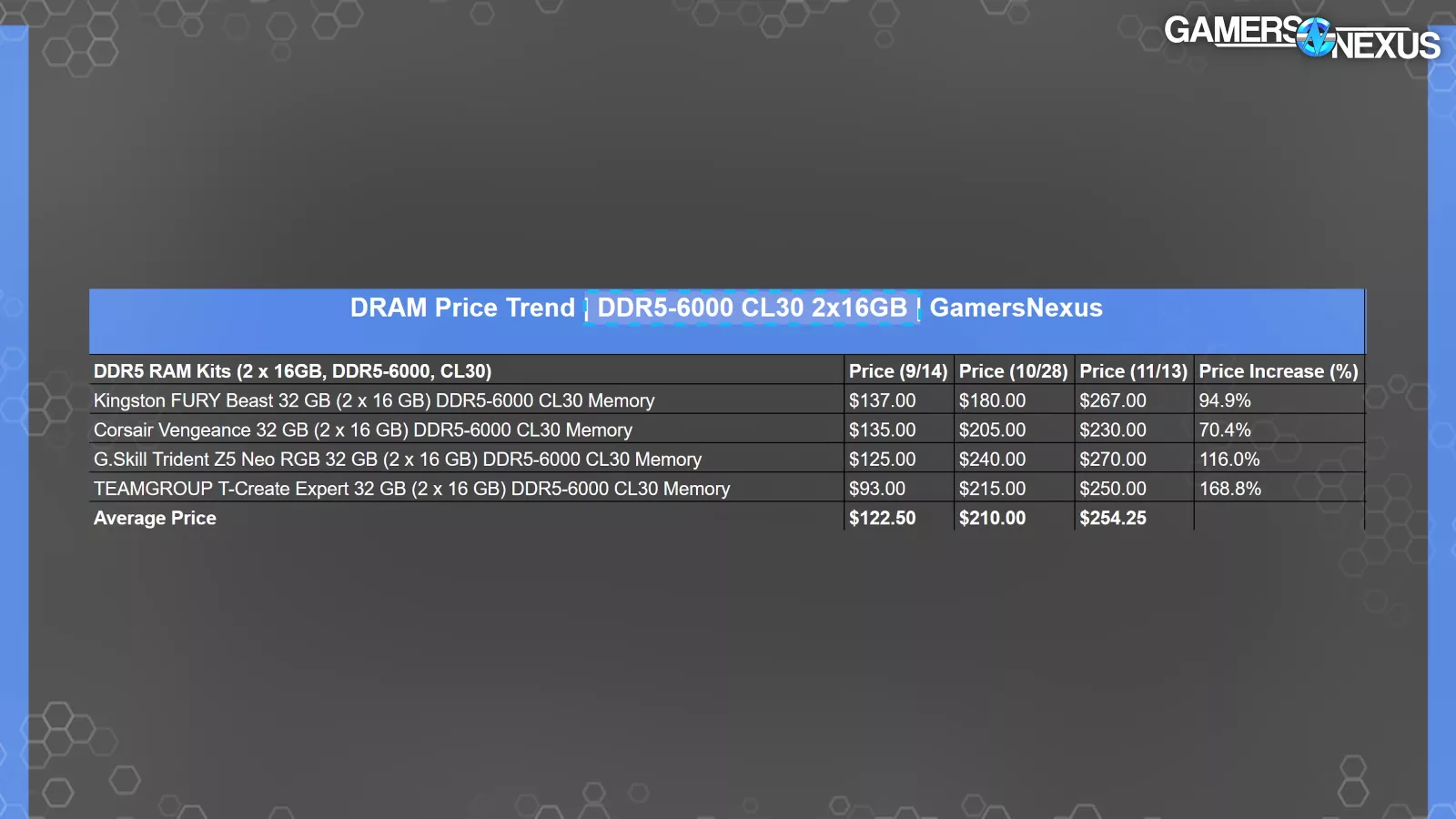

This table focuses on kits of 2 x 16GB DDR5-6000 CL30, with one kit each from four of the largest vendors. This table includes each listing’s Newegg price in mid-September, which is prior to the most apparent price increases, and then again in November.

We originally collected prices for October, but saw such an increase in the time between publishing and writing this story, which was only about a 10-day period, that we decided to recollect them and rework this story.

Since September:

G. Skill’s Trident Z5 NEO RGB kit increased by $145, from $125 in September to $270 the following month, making it the highest priced kit on the table. Just from October 28th to November 13th, we saw an increase of 13%. That’s nearly one percentage point per day in that time.

Kingston’s FURY Beast RAM saw price rise from $137 to $267, for a 95% increase.

Corsair Vengeance RAM climbed from $135 to $230, seeing a 70% increase.

TeamGroup’s T-Create Expert kit more than doubled in price, from $93 in September to $250 by the end of October. This is a 169% increase in a span of a little over a month. Just since October 28th, we’ve seen a 16% increase in price (from $215 to $250).

Broadly speaking, we’re seeing around a $130 price increase on this spec of kit since September. The average percent increase in price of comparable kits is in the range of around 100%, depending on if you expand the scope to other kits.

Price Increases: DDR5-7000+

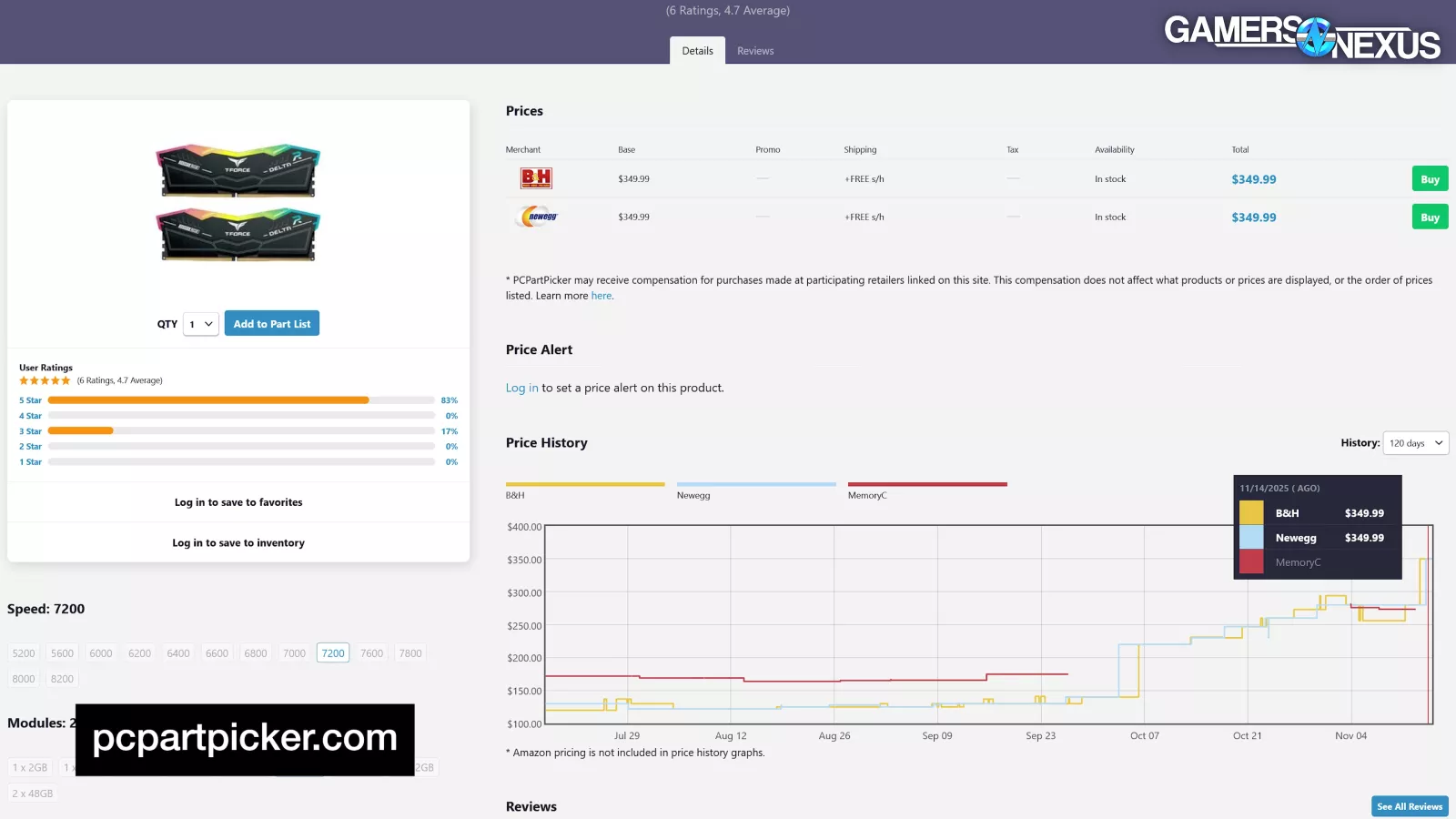

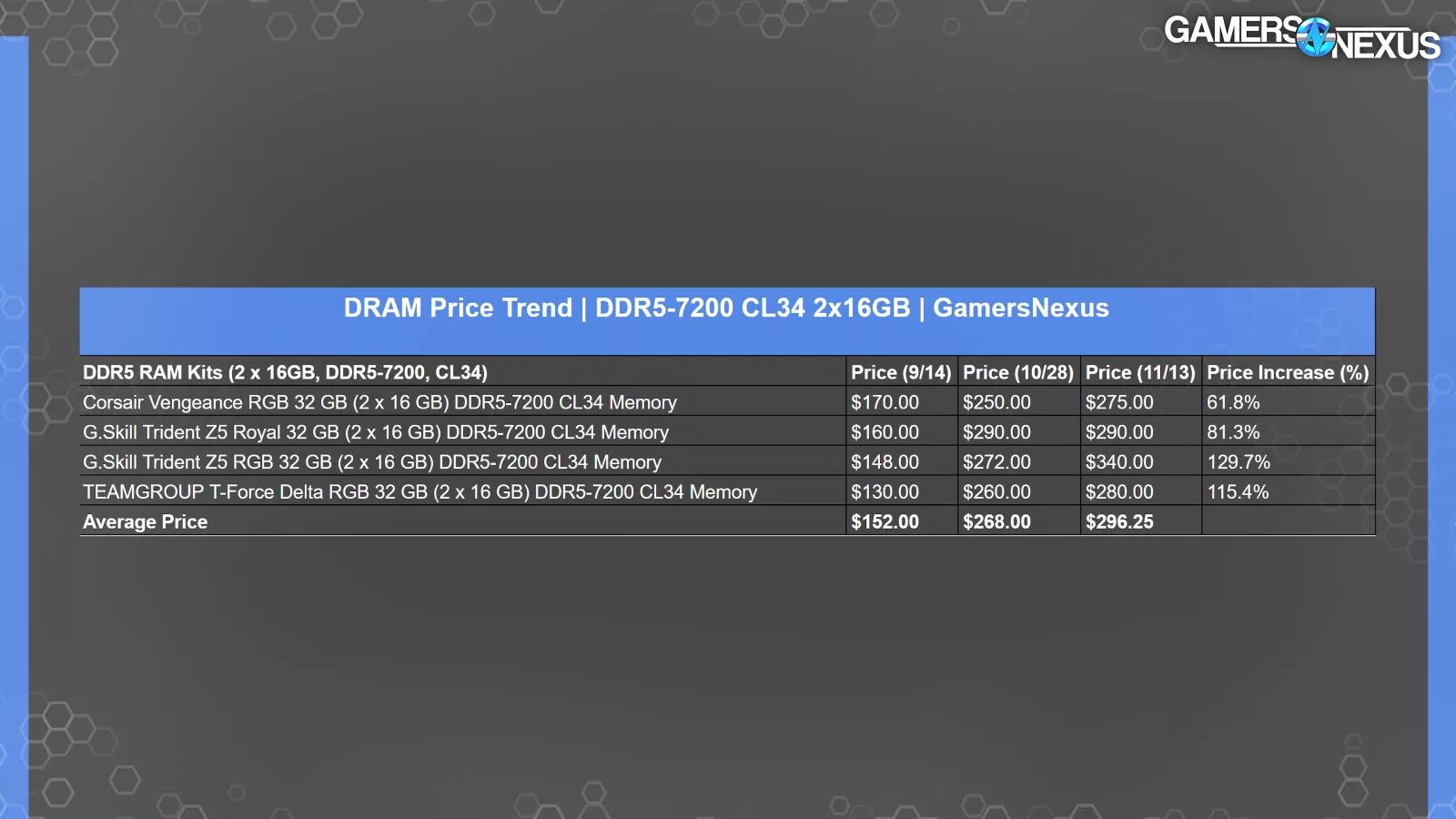

We also looked at some faster DDR5 kits to try and determine whether the substantial price increases would impact higher-end consumer kits disproportionately. Because high-end kits are less desirable in server deployments (although those use ECC typically), but are also more valuable, it’s an interesting data point. This table of DDR5-7200 32GB kits shows that prices basically followed the exact same pattern seen with DDR5-6000, despite the enthusiast positioning.

Naturally, the faster kits cost more in total (both in September and currently), with AVG prices of $152 and $296, but the percent increase in price is nearly identical for both DDR5 speeds.

The Corsair kit went up by $105, or 62%. In just the last two weeks, the broken-out increase was 10%. G.Skill’s Z5 Royal kit increased by $130, or 81%, with the Z5 RGB kit now at $340 from $148, or 130%. The Teamgroup kit went more than 2x, at $280 from $130 a little over a month prior to our data collection. That’s a 115% price increase.

Average price increase was also around 100% across a 1-2 month window for this speed.

A quick glance at other speeds suggests similar trends. The recent price increases look to have impacted all DDR5 speeds mostly proportionately, which unfortunately suggests that no options are safe from the absurd price hikes we’ve seen recently.

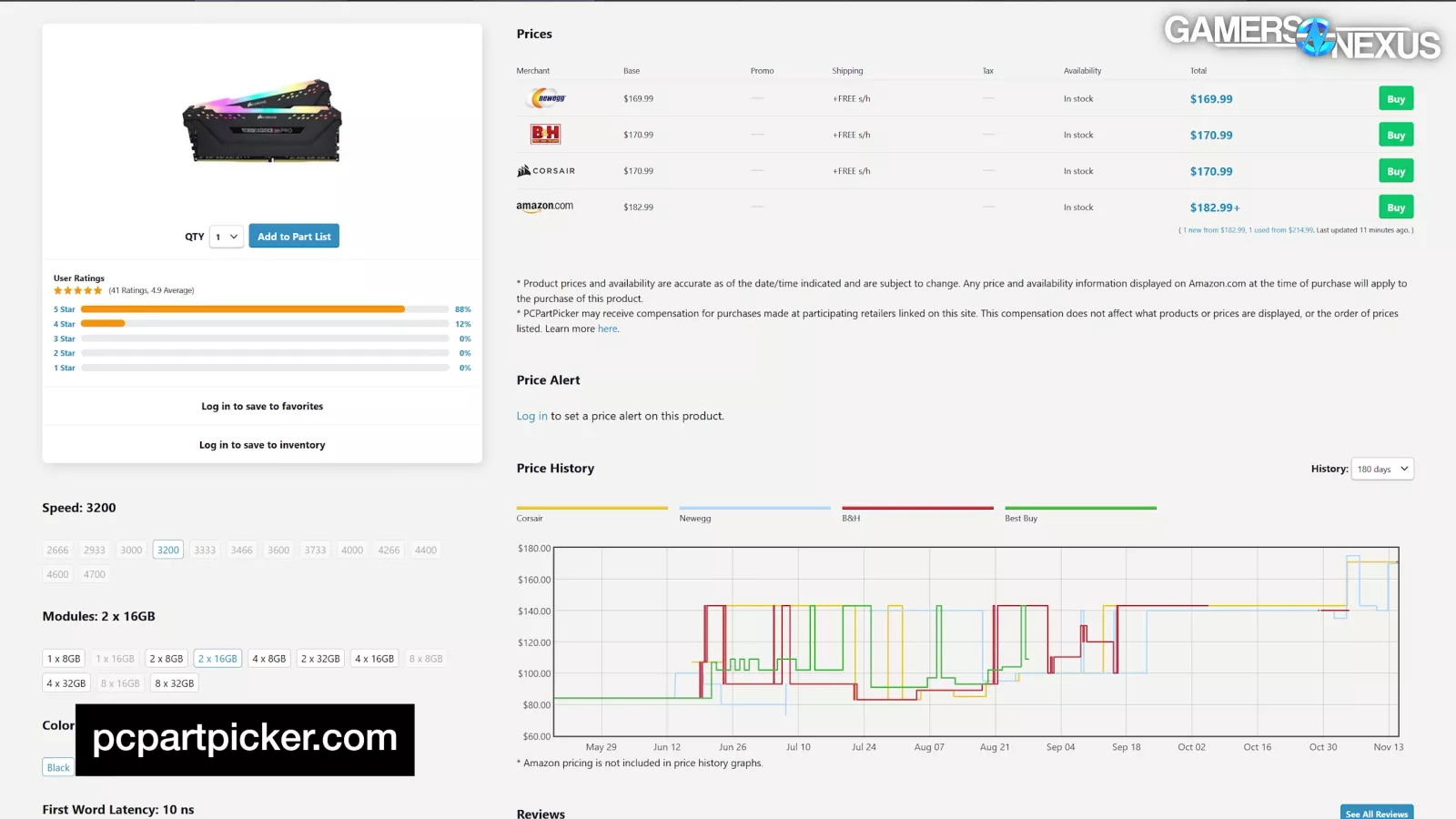

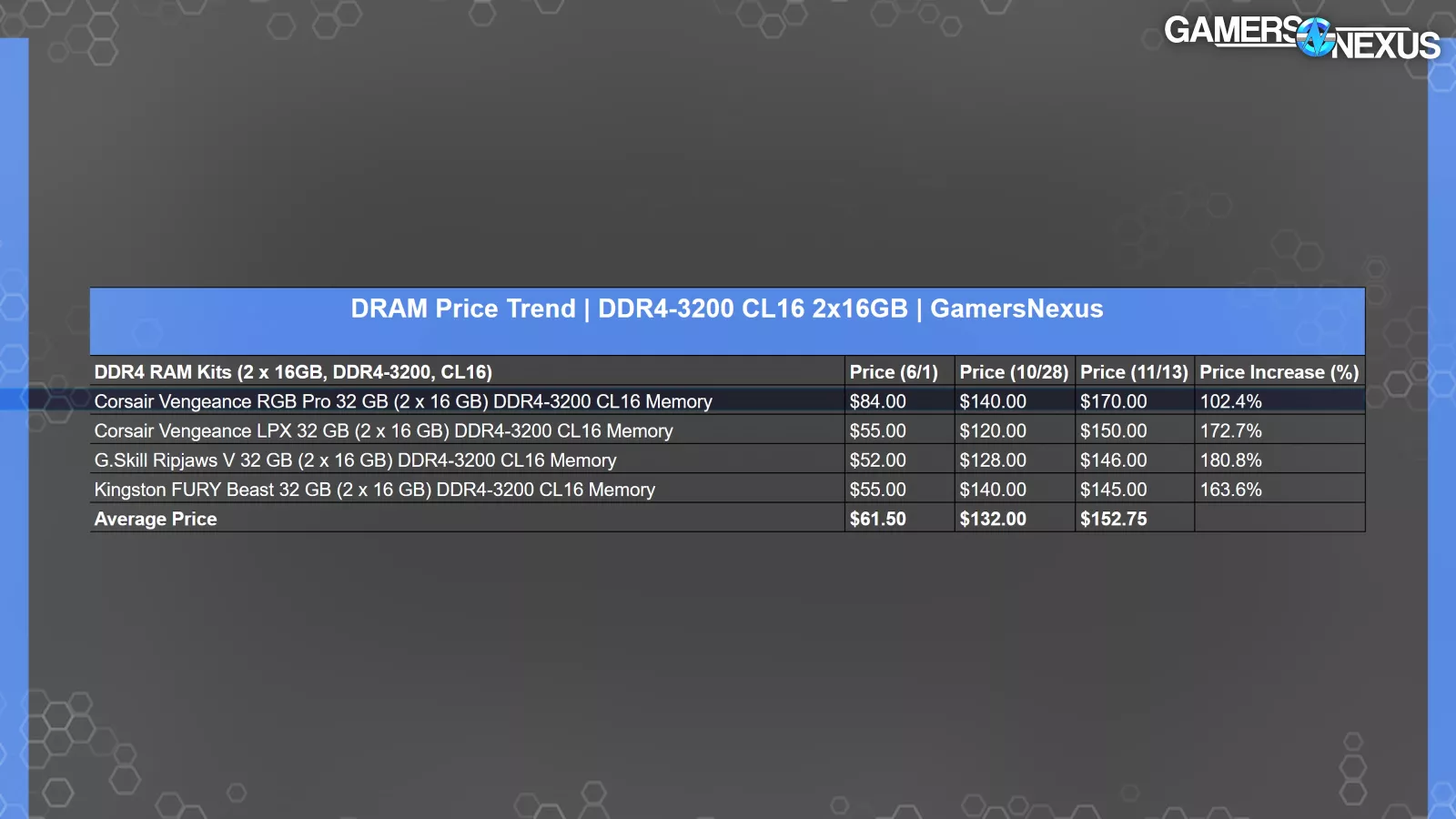

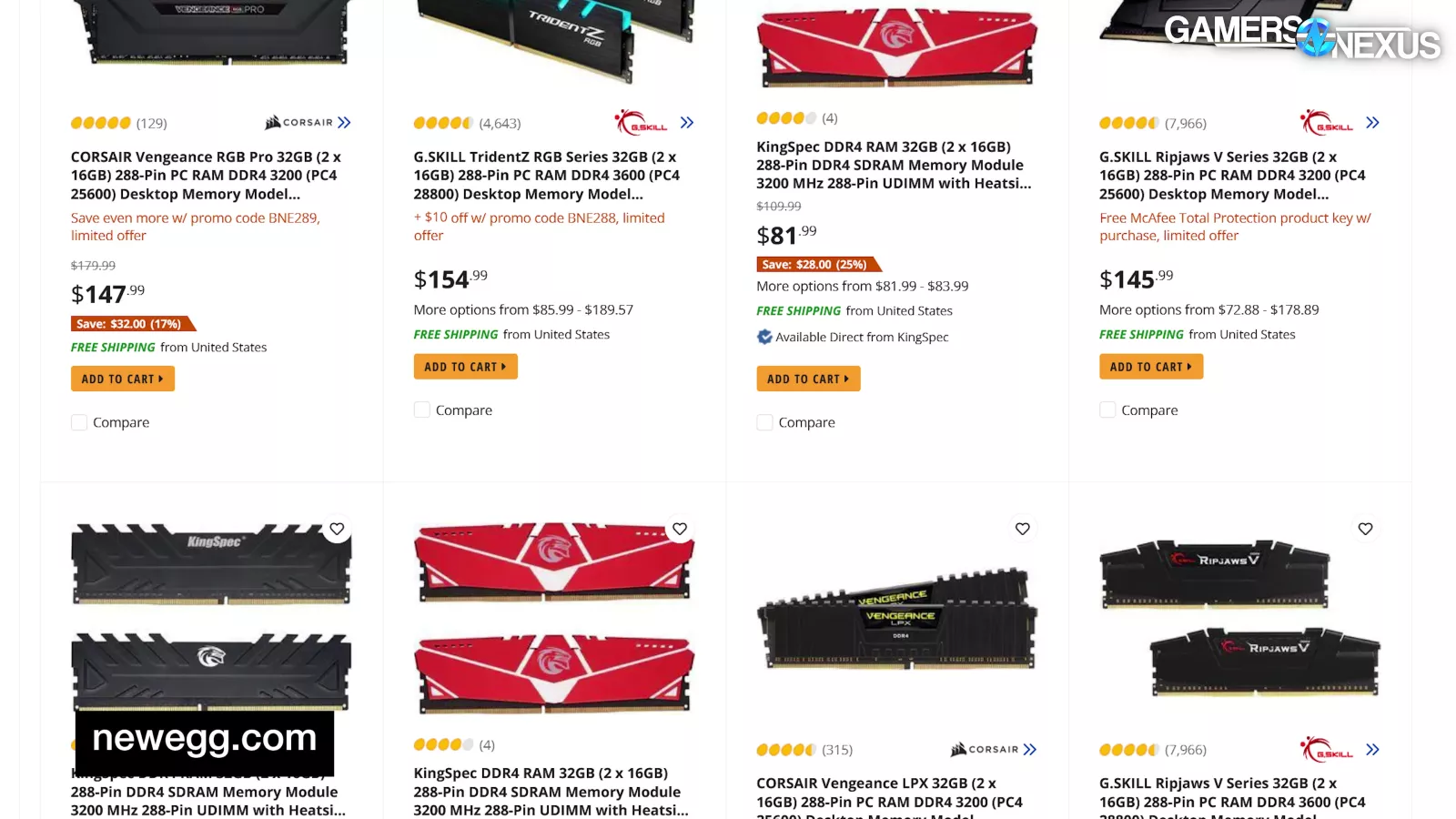

Price Increases: DDR4-3200

| DDR4 RAM Kits (2 x 16GB, DDR4-3200, CL16) | Price (6/1) | Price (10/28) | % Reduction from Current to Previous Price | Retailer |

| Corsair Vengeance RGB Pro 32 GB (2 x 16 GB) DDR4-3200 CL16 Memory | $84.00 | $140.00 | -40.0% | Newegg |

| TEAMGROUP T-Force Vulcan Z 32 GB (2 x 16 GB) DDR4-3200 CL16 Memory | $51.00 | $120.00 | -57.5% | Newegg |

| G.Skill Ripjaws V 32 GB (2 x 16 GB) DDR4-3200 CL16 Memory | $52.00 | $128.00 | -59.4% | Newegg |

| Kingston FURY Beast 32 GB (2 x 16 GB) DDR4-3200 CL16 Memory | $55.00 | $140.00 | -60.7% | Newegg |

| AVGs | $60.50 | $132.00 | -54.2% |

DDR4 is next. The memory is still relevant for AM4 platforms and homelab type uses, but it’s also interesting because DDR4 has had its production wind-down over the past couple years. This could have a compounding effect of price hikes plus dwindling supply.

We’ll focus on kits of 2 x 16GB DDR4-3200 CL16 with an expanded date range of June 1st to November 13th. There was the most data for this spec. So that’s why we chose it.

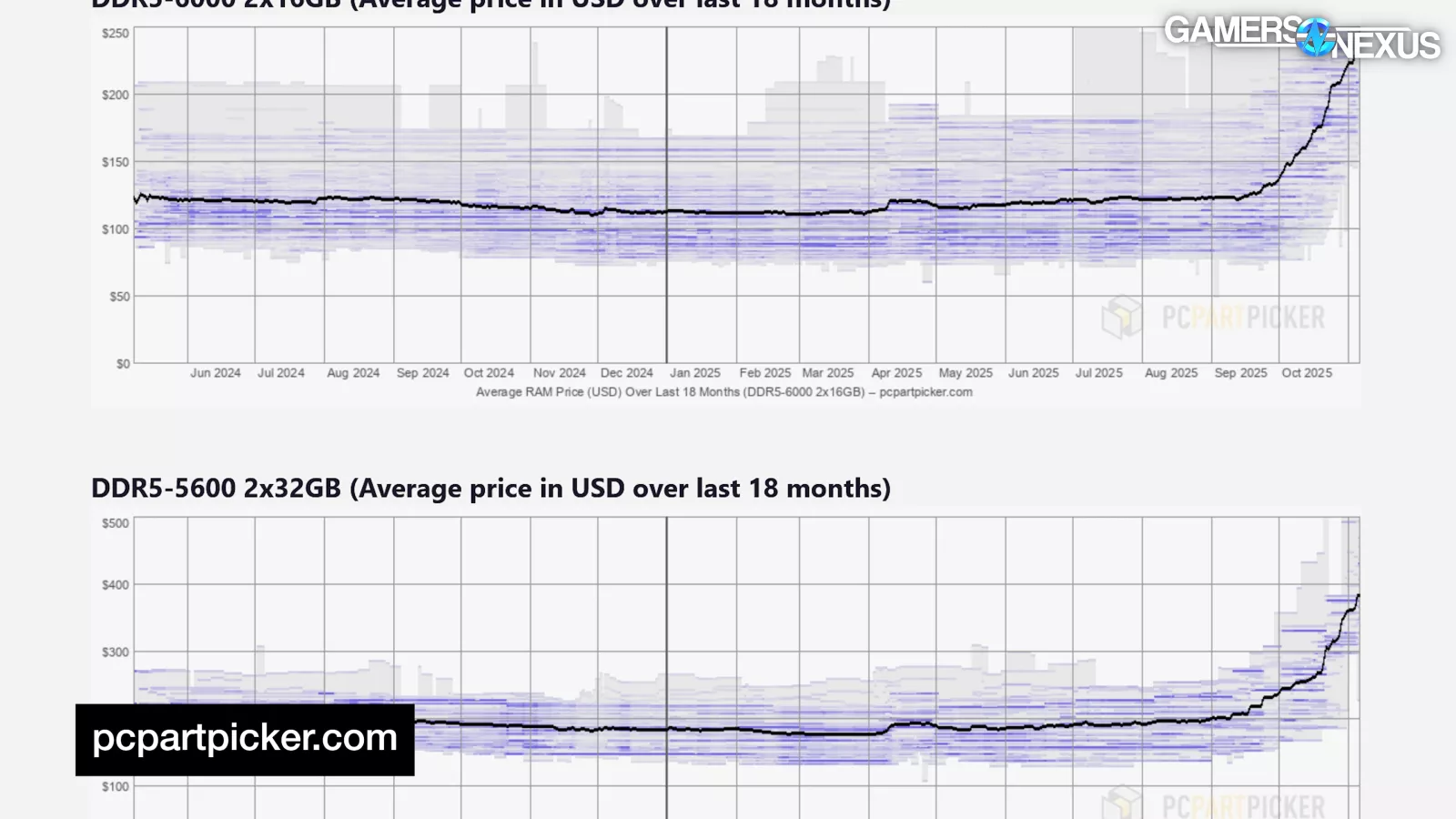

Using PCPartPicker’s “Current Memory Price Trend” graphs, we found that, unlike DDR5, which only saw prices beginning to increase in September, DDR4 encountered two noticeable increases this year. The first was in June (likely due to several DDR4 EOL announcements around then) and again in October, coinciding with the more recent climb in prices. The EOL announcements would coincide with a reduction in new supply.

Since June:

Corsair’s Vengeance RGB kit climbed in price from $84 to $170, or 102%.

Corsair’s Vengeance LPX RAM saw price grow by $95, from $55 in June to now $150.

G. Skill’s Ripjaws V kit price rose considerably, from $52 to $146, or 180% higher than it was.

Kingston’s Fury Beast increased from $55 in June to $145 presently, a 163% increase in a span of months.

Compared to DDR5, DDR4 saw greater price increases by percentage, which we think is a combination of DDR4 memory still being in-demand for both servers and consumers while also winding-down production or going EOL with some supply.

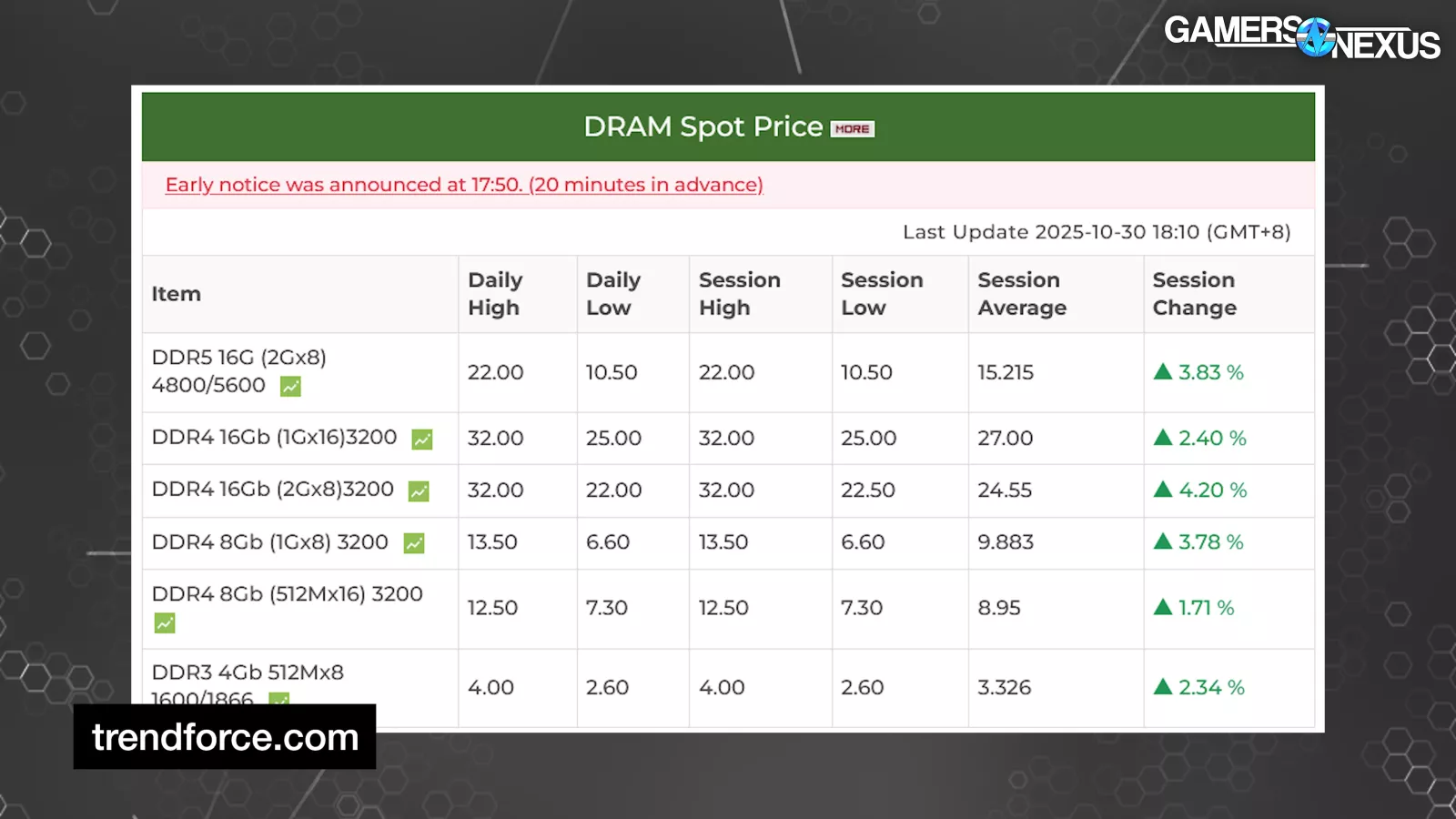

DRAM Spot Price

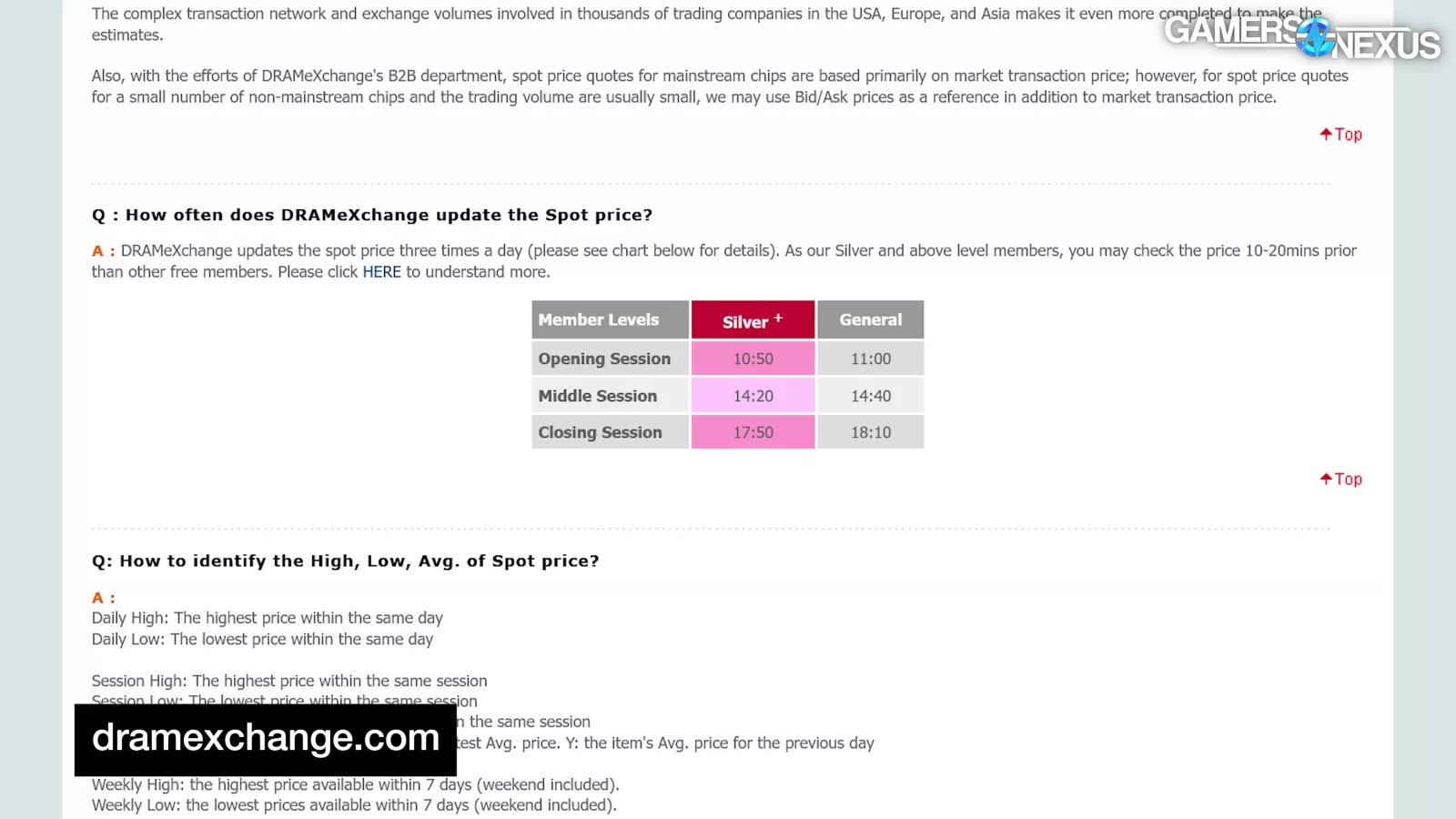

We’ll take a look at the 2Gx8 spot prices for both DDR4 and DDR5.

Spot price for DRAM is similar to spot price for any other asset or valuable good.

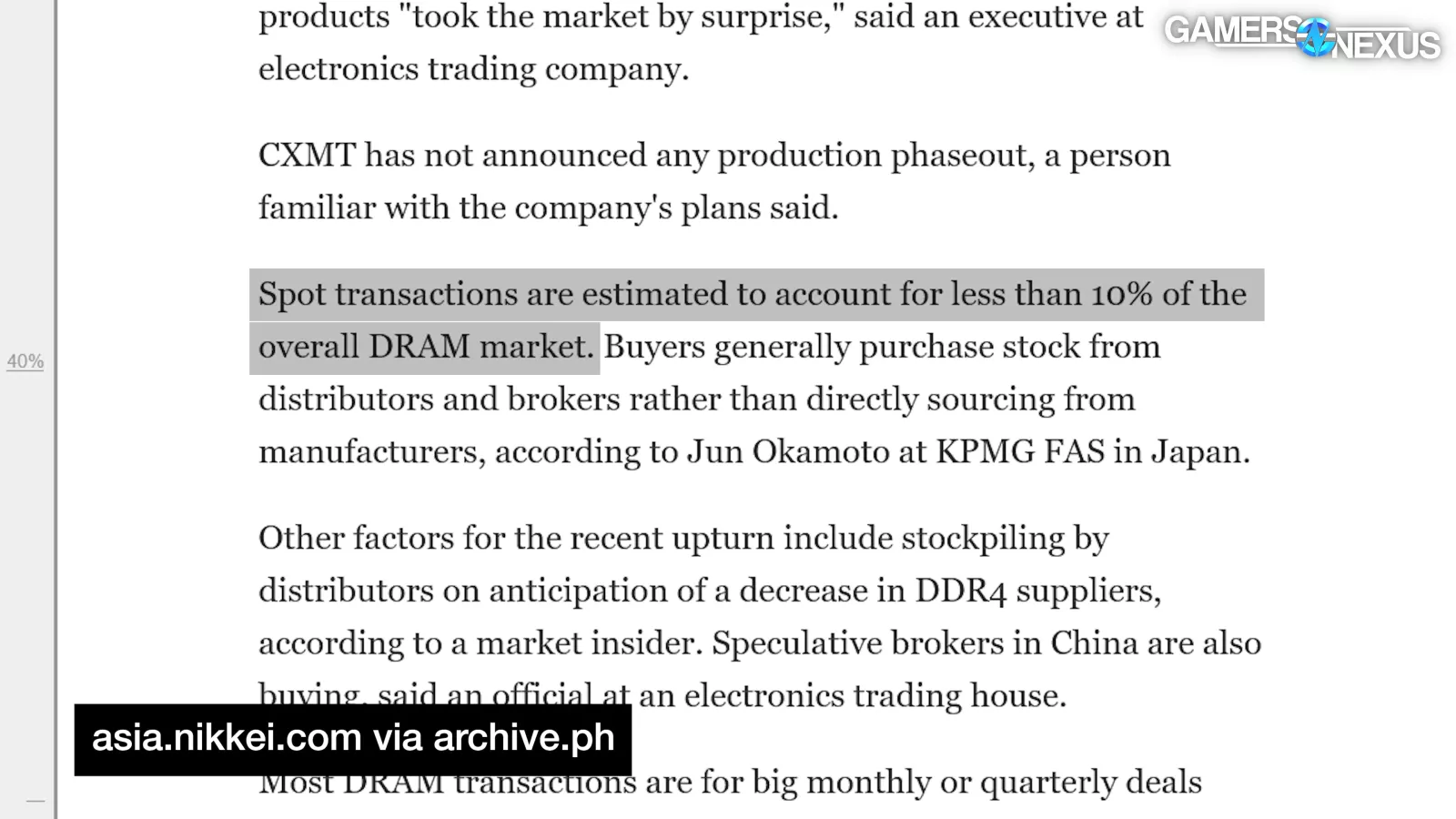

Nikkei Asia Review states that “spot transactions are estimated to account for less than 10% of the overall DRAM market,” noting that DRAM distribution tends to go through middle-people rather than direct sourcing.

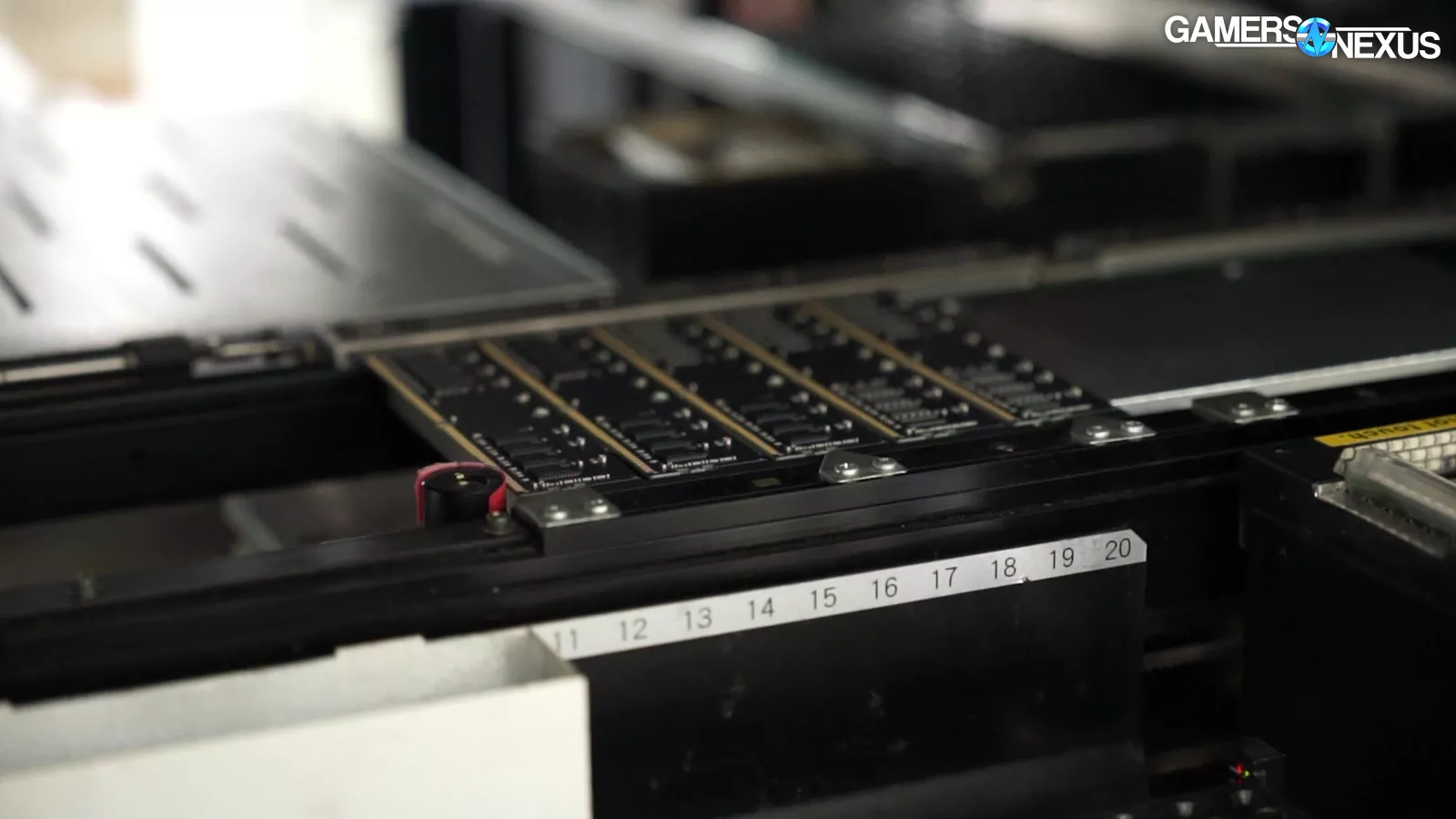

Memory sticks are made in SMT lines, with brands like Corsair, Kingston, and G.Skill doing the testing and configuration of the kits, plus potential binning.

You can see that in this footage from our factory tour of V-Color’s RAM binning and manufacturing line previously.

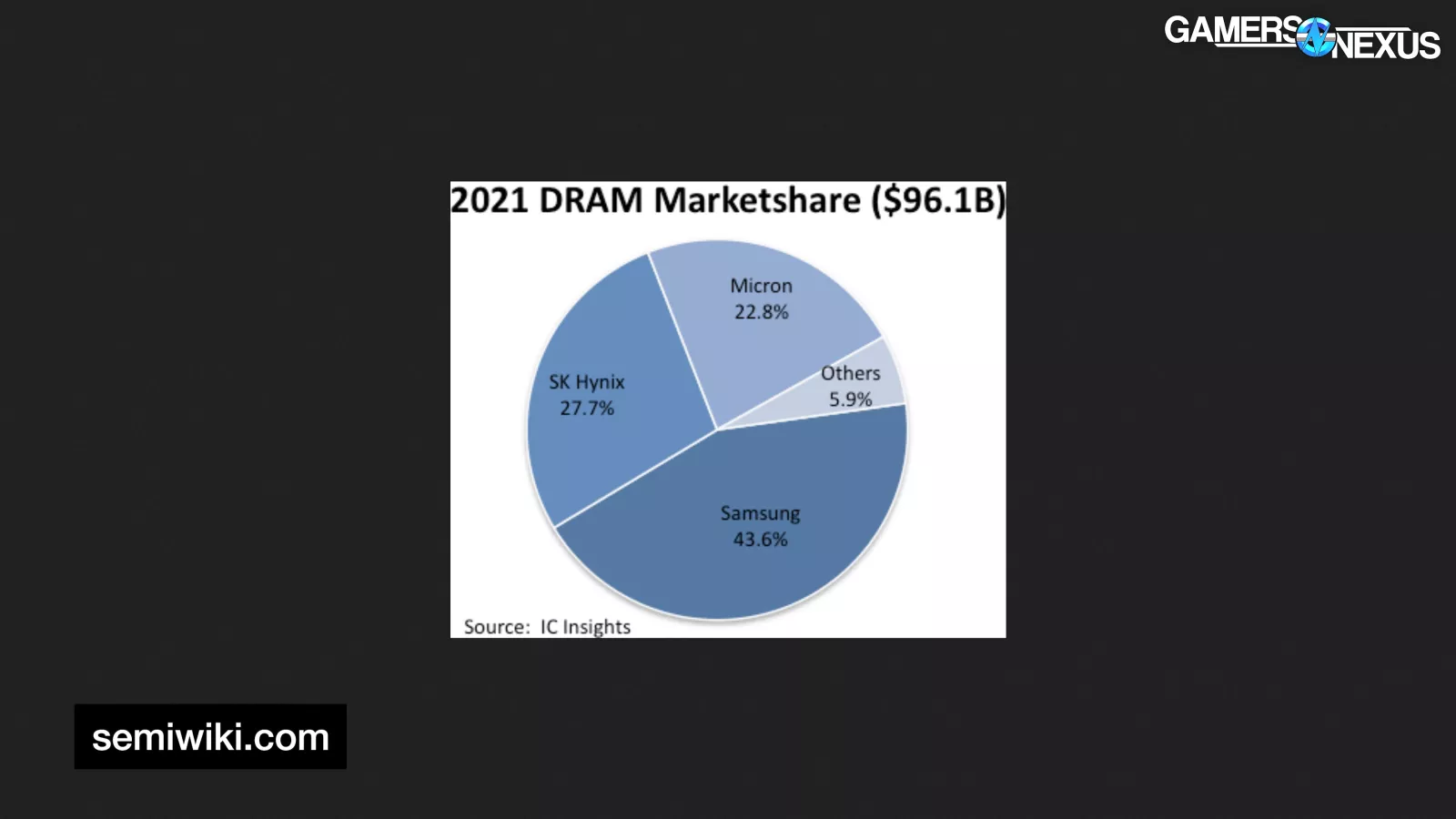

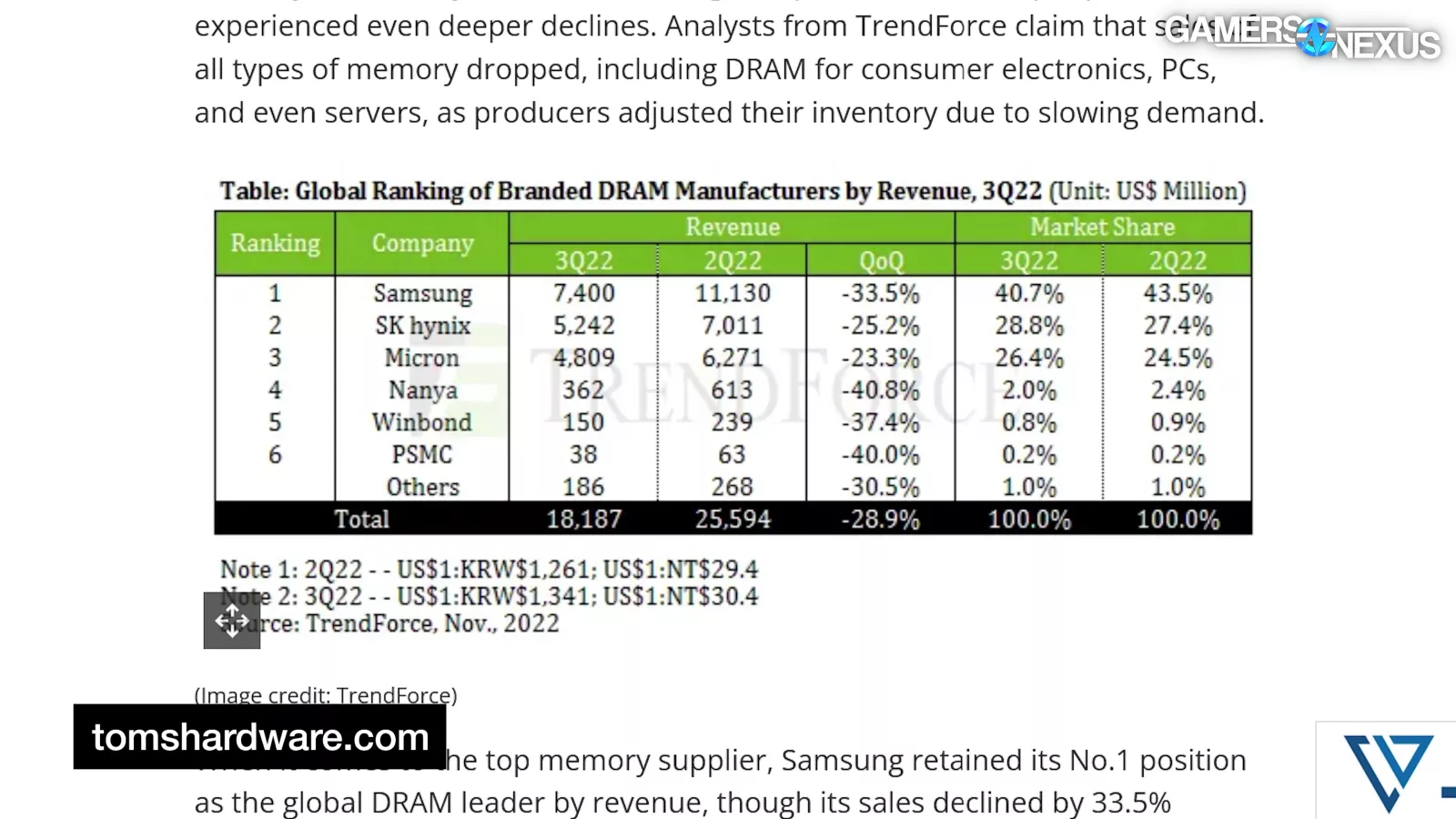

These manufacturers buy the memory silicon from one of 3 common suppliers: Samsung, SK Hynix, or Micron. IC Insights’ 2021 report indicated only 6% share for others.

Anyway, we’ll get to the spot price, but the point is that it’s mostly just 3 suppliers controlling those prices in totality. The down-chain stick makers can still benefit from price increases if they adjust existing memory up.

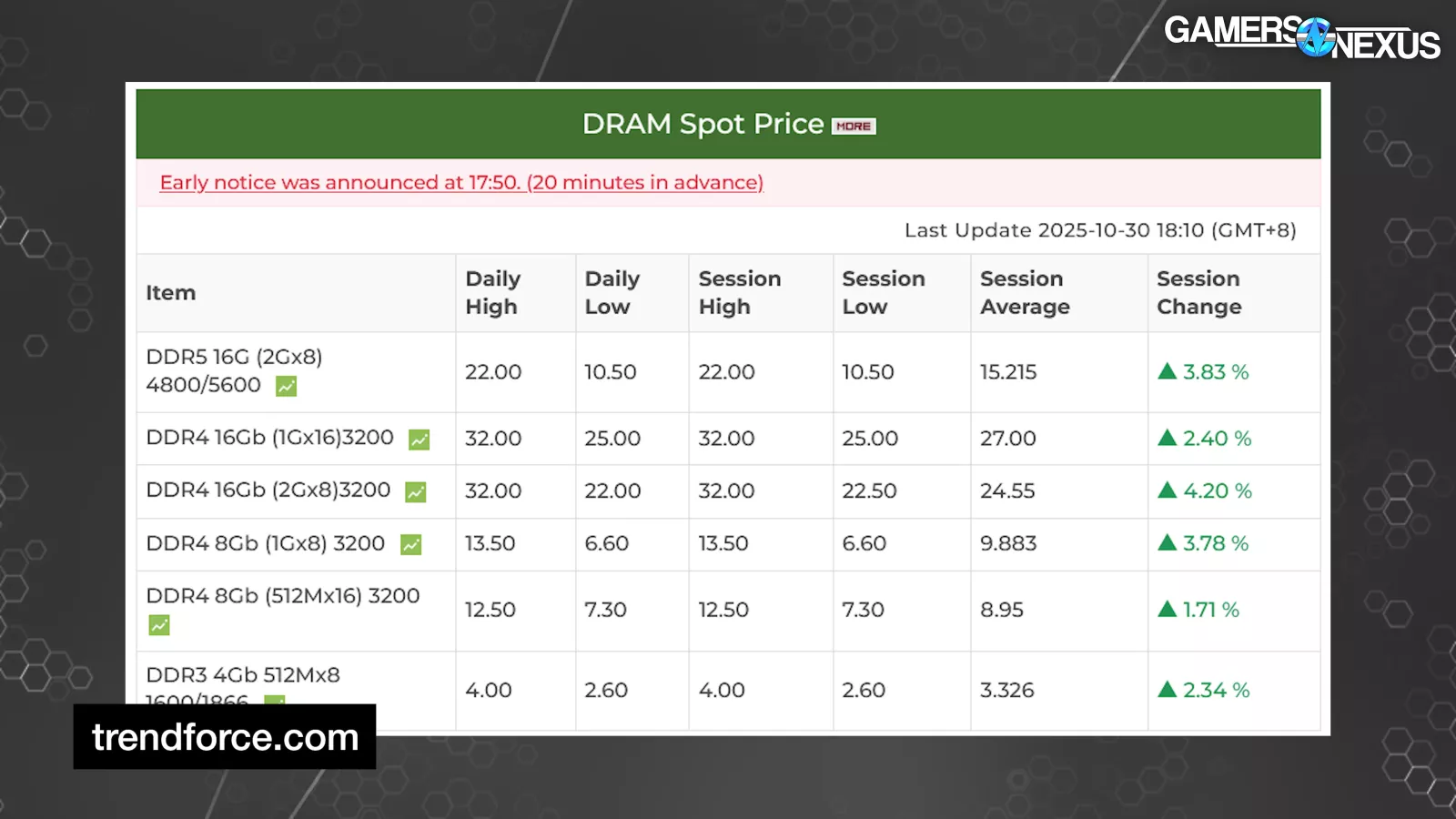

DDR5 sticks have a higher cost per stick on average, but DDR4’s spot price far outweighs DDR5’s.

At the time of writing this, DDR4’s 16Gb spot price saw a session AVG of $24.55. DDR5 16Gb solutions at 4800/5600 were $15.2 for the session average. These are not directly comparable by capacity and speeds just due to the differences in DDR4 and DDR5, but the session change is. You can see that session-over-session, these all have increases.

DDR4 is disproportionately expensive at this stage.

Based on our understanding of spot price, we’d assume DDR4 prices will eventually cost more than DDR5, as RAM vendors sell out of their remaining wafer supplies.

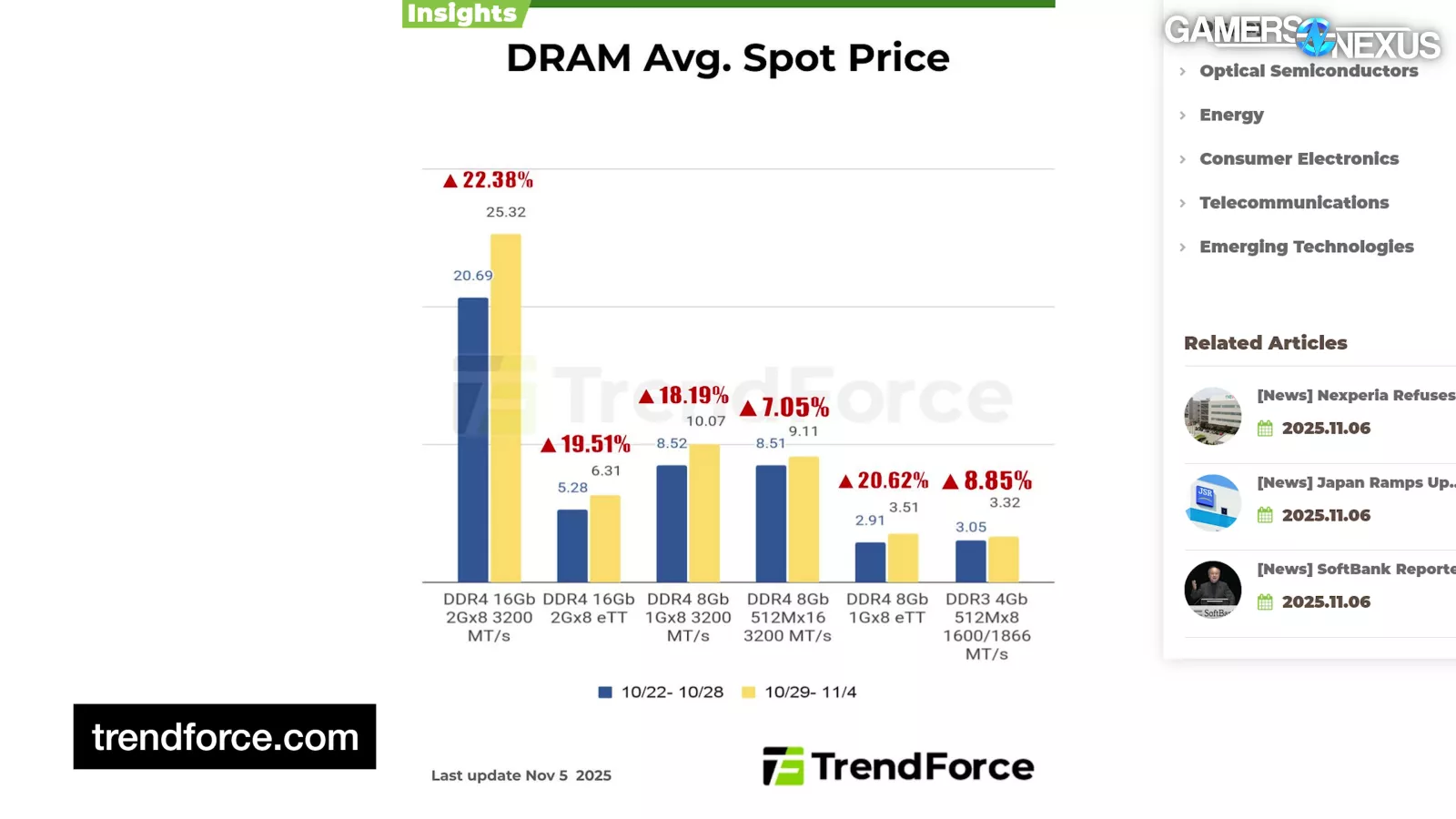

DDR4 Spot Price Increases (week-to-week)

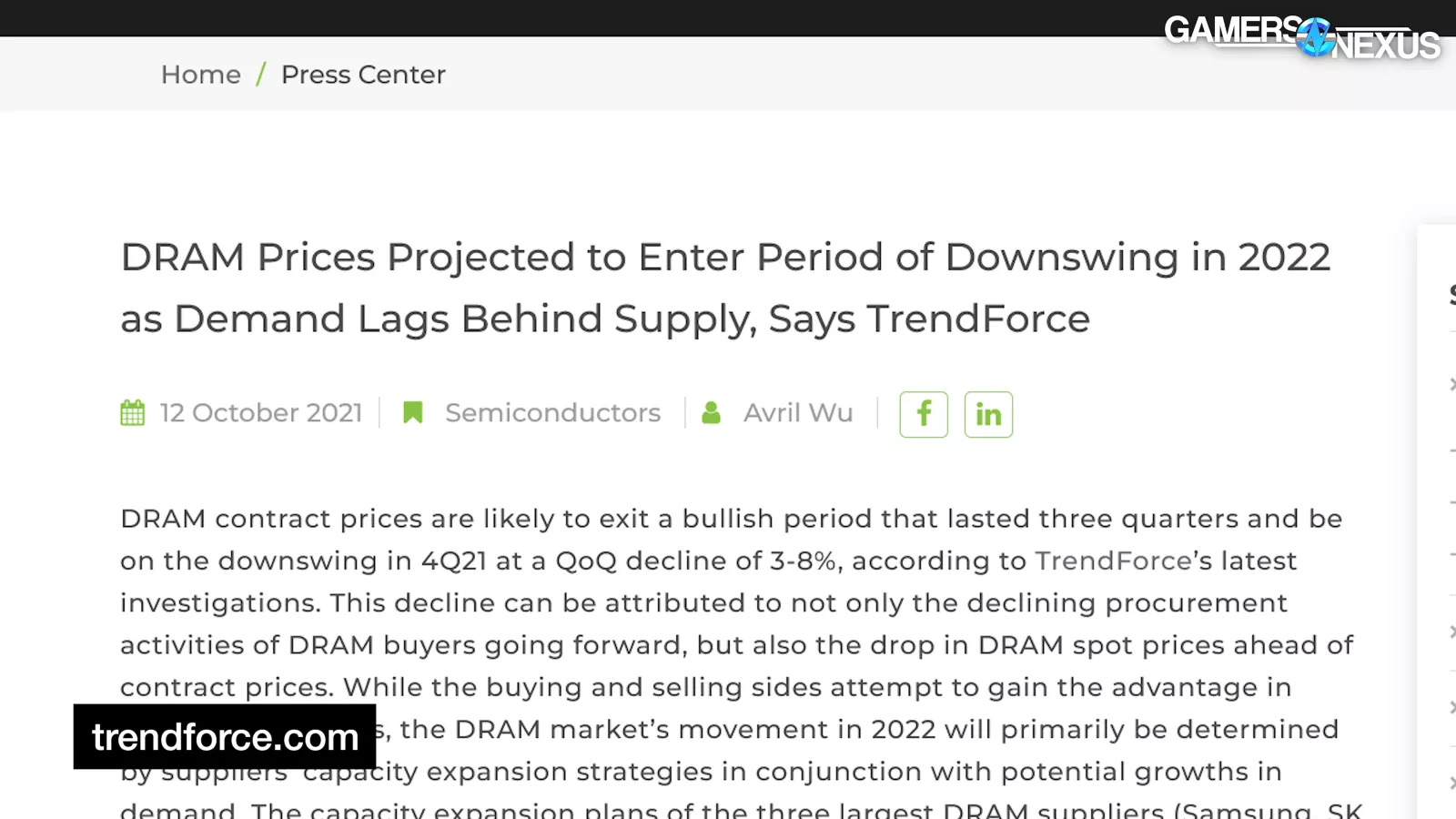

For a sense of how rapidly these changes are taking place, this TrendForce chart shows DDR4’s spot price increases on a week-to-week basis.

From the week beginning 10/22 to the following week, DDR4 AVG spot prices increased for all quantities and speeds offered, with increases of 7.05% on the low end and up to 22.38% on the high. This is just week-to-week pricing.

While it’s not shown in the chart, TrendForce claims DDR5’s price inflated by 30% in the same week. The analysis firm attributed the rapid increases to “severe hoarding” as buyers rush to stock supplies.

We’ll come back to spot prices later, but for now let's dive into the market’s history for some additional context.

The DRAM Cartel

The DRAM market hasn’t been normal since COVID. To be fair, the DRAM market in particular has a uniquely corrupt history in PC hardware with multiple convictions and literal cartels, but since COVID in particular, it has had wilder price swings.

The increase in work-from-home users saw demand surge as everyone upgraded or built at-home workstations, causing manufacturers to ramp up production. But DRAM companies seem to not like oversupplying the market, since they then water-down the value of their own product.

Unfortunately, or maybe not, the heightened demand was extremely short-lived, mostly due to inflation and general uncertainty. Manufacturers quickly found themselves overstocked with inventory nobody wanted, and eventually resorted to cutting production levels in the years that followed.

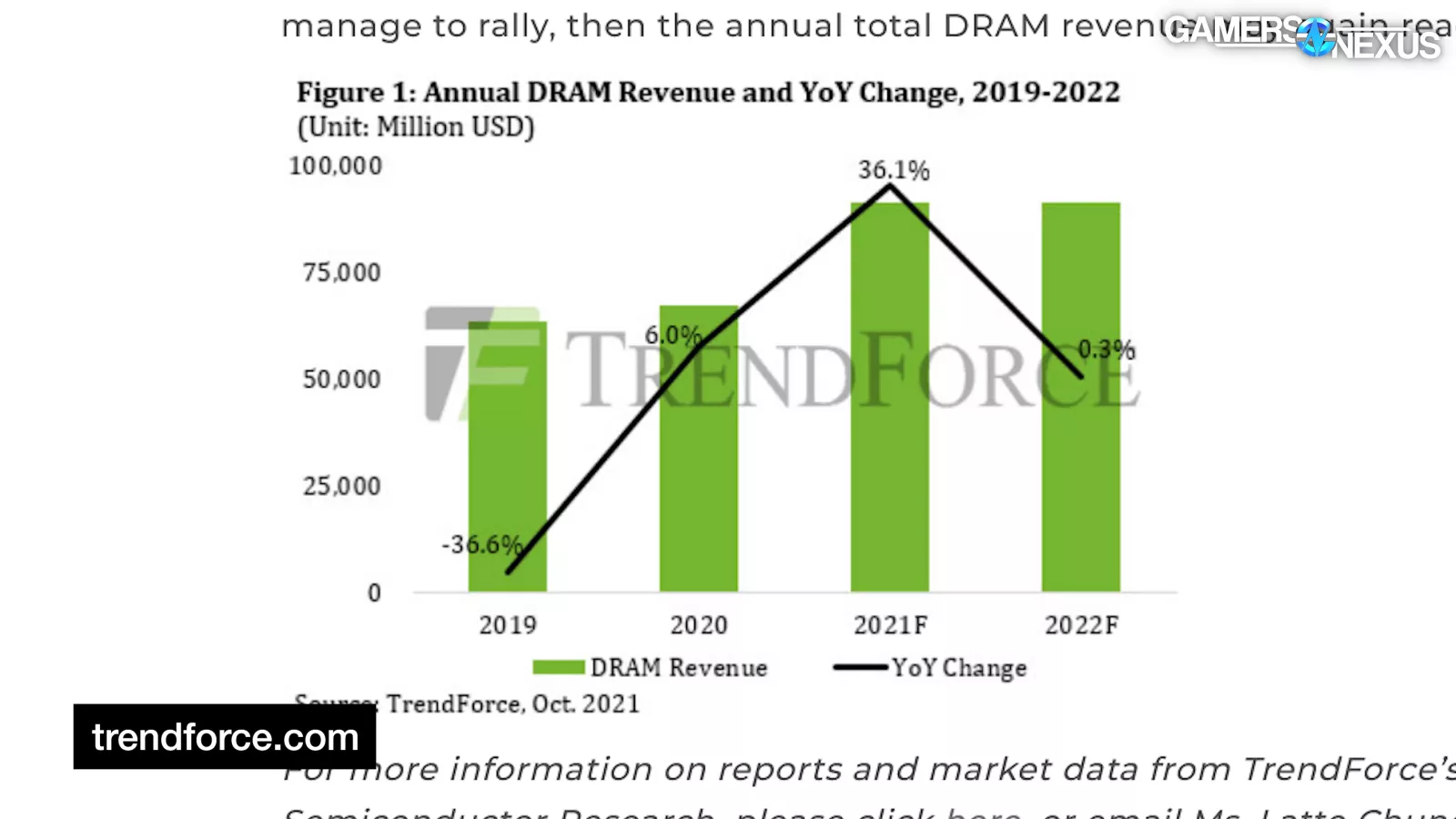

The most significant cuts occurred in late 2022 and early 2023, around the same time global DRAM revenue decreased by an unprecedented 30% QoQ in Q3 2022.

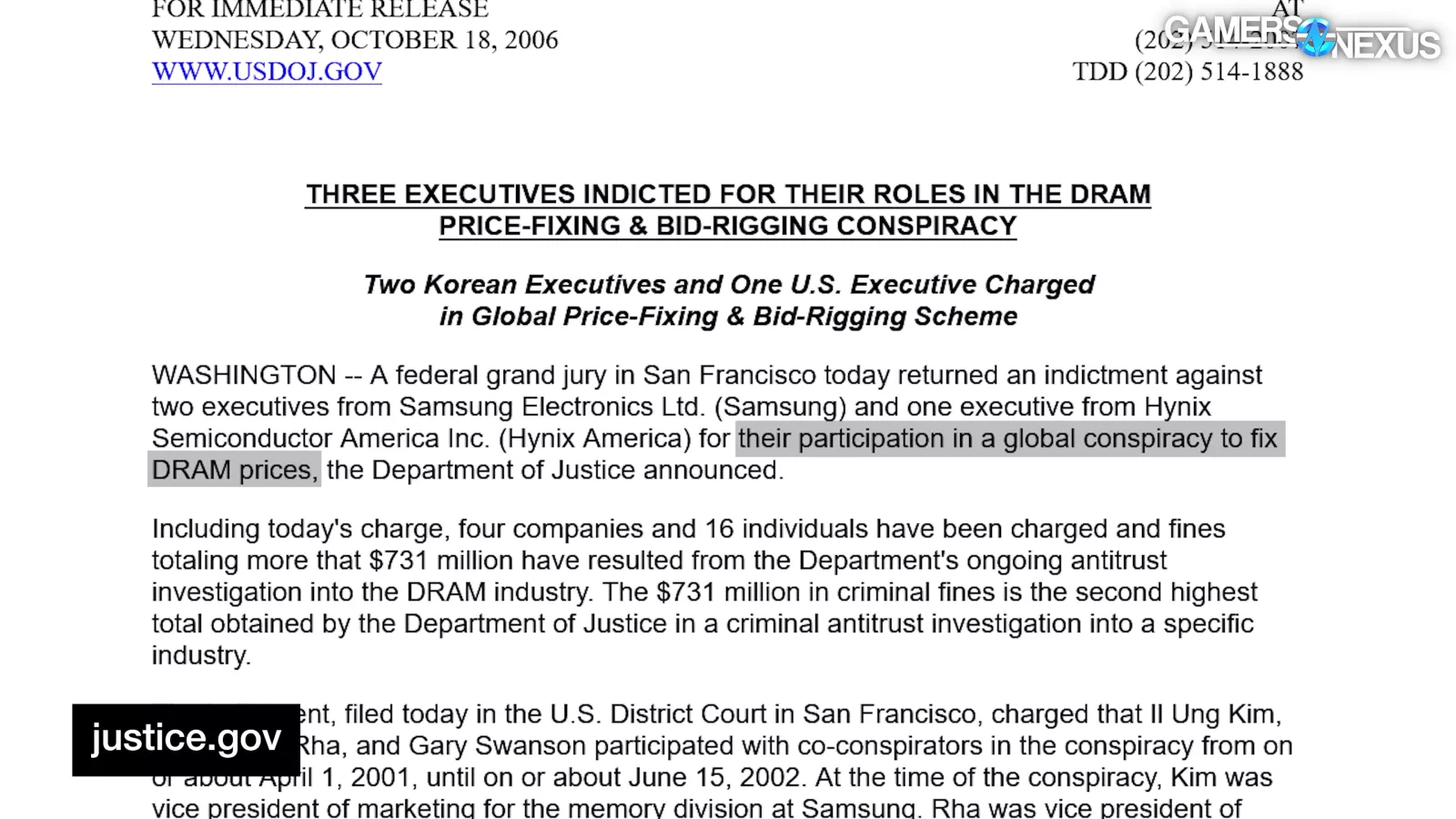

Coming back to the cartels: The DRAM market is so sensitive to supply and demand that in the past, we’ve even seen the largest manufacturers engaging in price-fixing scandals to ensure stable prices.

In other words, a gentleman’s agreement that, “y’know, if we both lower our prices, we both make less money.”

In 2006, the Department of Justice indicted two executives from Samsung and one from SK Hynix for “their participation in a global conspiracy to fix DRAM prices,” after evidence showed that the competitors had basically agreed on pricing together.

In 2022, another antitrust case was filed, though the case was ultimately dismissed due to insufficient evidence.

The point is: the DRAM market is volatile, and manufacturers commonly reduce output levels to stabilize the price, as we’ve experienced for the last few years.

It wasn’t until the end of 2023 that prices had finally begun to improve in the manufacturers’ favor, a result of the substantial production cuts made since COVID. Throughout 2024, prices gradually increased as the market returned to an equilibrium, bringing us to 2025.

Other historical sensitivities have included earthquakes and other natural disasters, such as in Taiwan in 1999 or in South Korea in 2020 due to a power outage that destroyed millions of dollars of inventory. Reuters notes that a 30-minute outage in 2018 cost $43 million in losses, including wafer losses.

More recently, the natural disaster is less natural and more artificial: AI server demand has driven the price through the ceiling.

Server DDR5

Although reports from first-party manufacturers and analysis firms like TrendForce indicate demand for desktop DDR5 remained relatively weak, business demand for server DDR5 and HBM surged this year.

Enterprise and server users are typically on ECC RDIMMs rather than the non-ECC UDIMM DDR5 used on desktop.

Manufacturers were quick to capitalize on the emerging Server DDR5 demand.

Found via Tom’s Hardware, Samsung recently raised RDIMM contract prices by as much as 50% for 4Q 2025 and major buyers are now receiving only 70% of the server DRAM ordered.

In an October 2025 report, TrendForce highlights server memory’s growing popularity, stating, “Server shipments and per-system memory density are rising in tandem, driving significant bit-demand growth and extending the supply–demand gap across calendar years.”

HBM

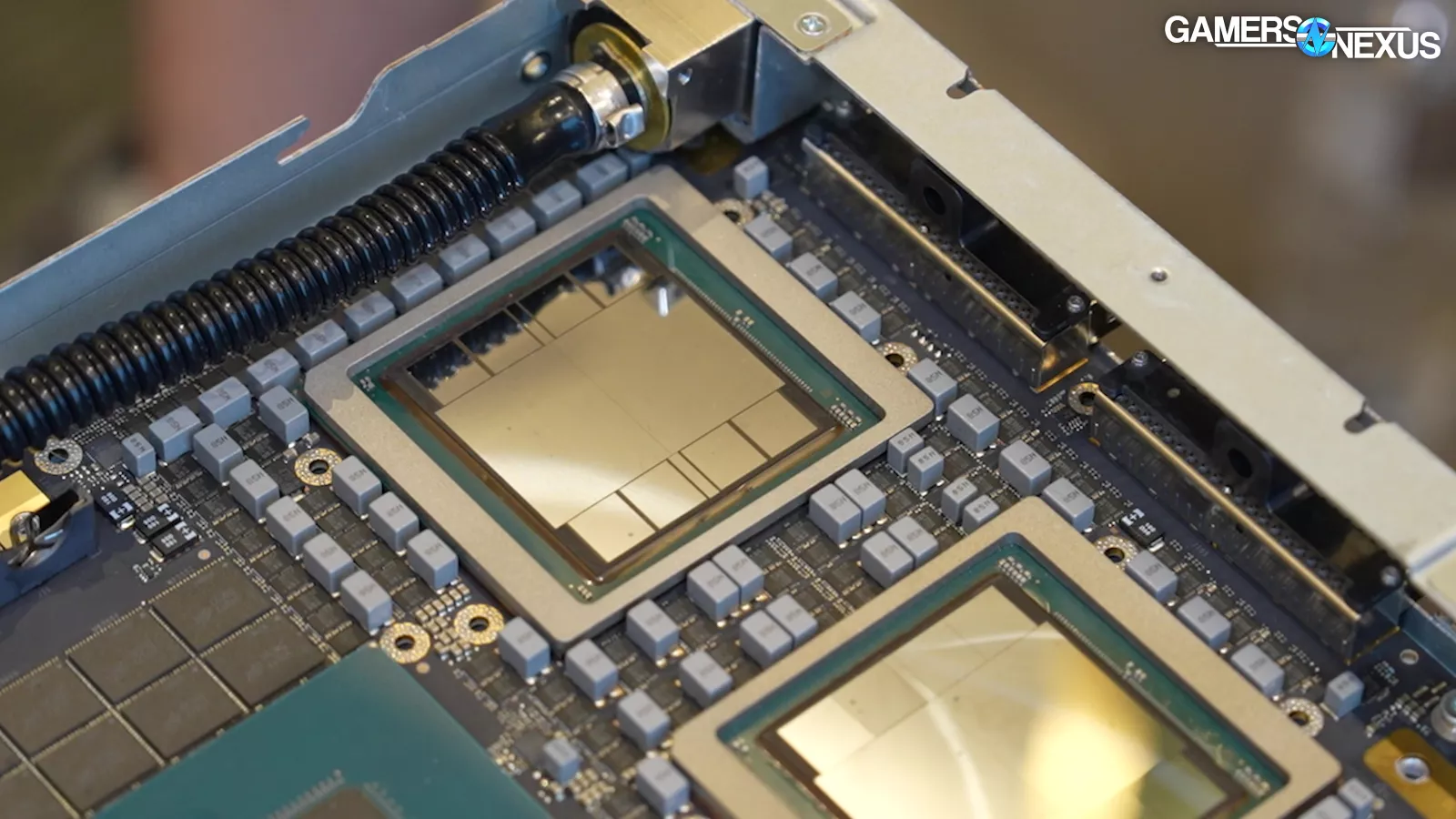

And then there’s HBM. Demand for HBM also took off this year as a result of its use in several high-end data center GPUs now.

High-bandwidth memory had numerous attempts at deployment on consumer GPUs, but ultimately was too expensive to make sense.

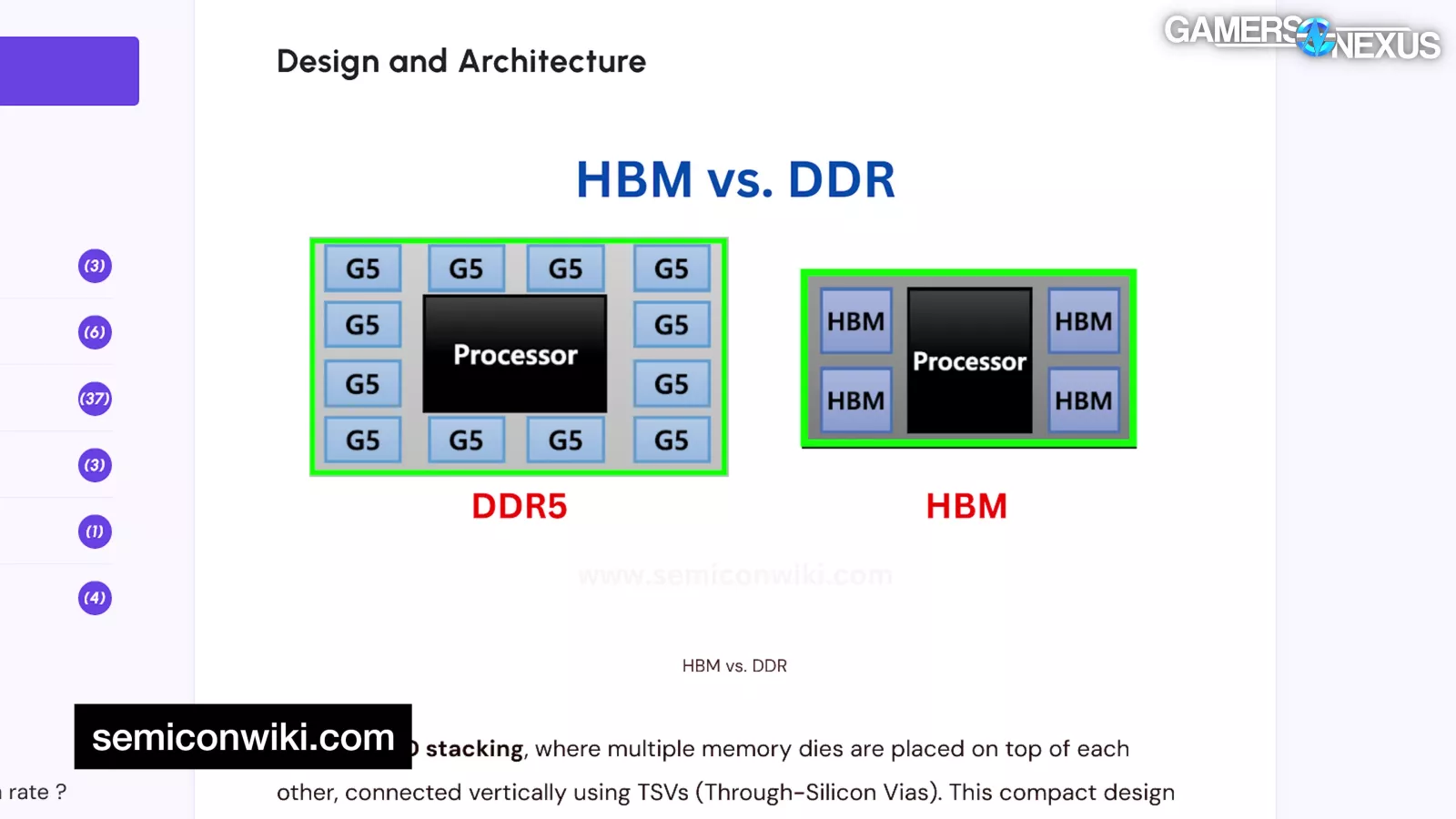

Instead of memory modules laid side-by-side, like on a RAM stick or around a GPU, HBM stacks the memory dies and is able to pack them into a denser area, often onto an interposer, to get them closer to the GPU or CPU.

In terms of resource usage, TrendForce states, “HBM consumes over three times the wafer capacity of standard DRAM.”

Not only is there stronger demand for server DDR5 and HBM, but there’s also reportedly higher margin from it, causing manufacturers to prioritize their wafer production towards those products if they’re able to sell them.

Long-Term Spot Price Trend

Server DDR5 and HBM demand isn’t just higher than desktop DDR5 RAM – its demand is unprecedented for the DRAM industry and it’s altering the market’s nature.

“The memory industry has historically followed a cyclical pattern, with each cycle lasting about 3.5 to 4.5 years. However, this AI-driven cycle is abnormal; the upward cycle is being stretched, and cyclical regularity may be disrupted. Downstream customers expect the shortage boom to last at least four years or more.”

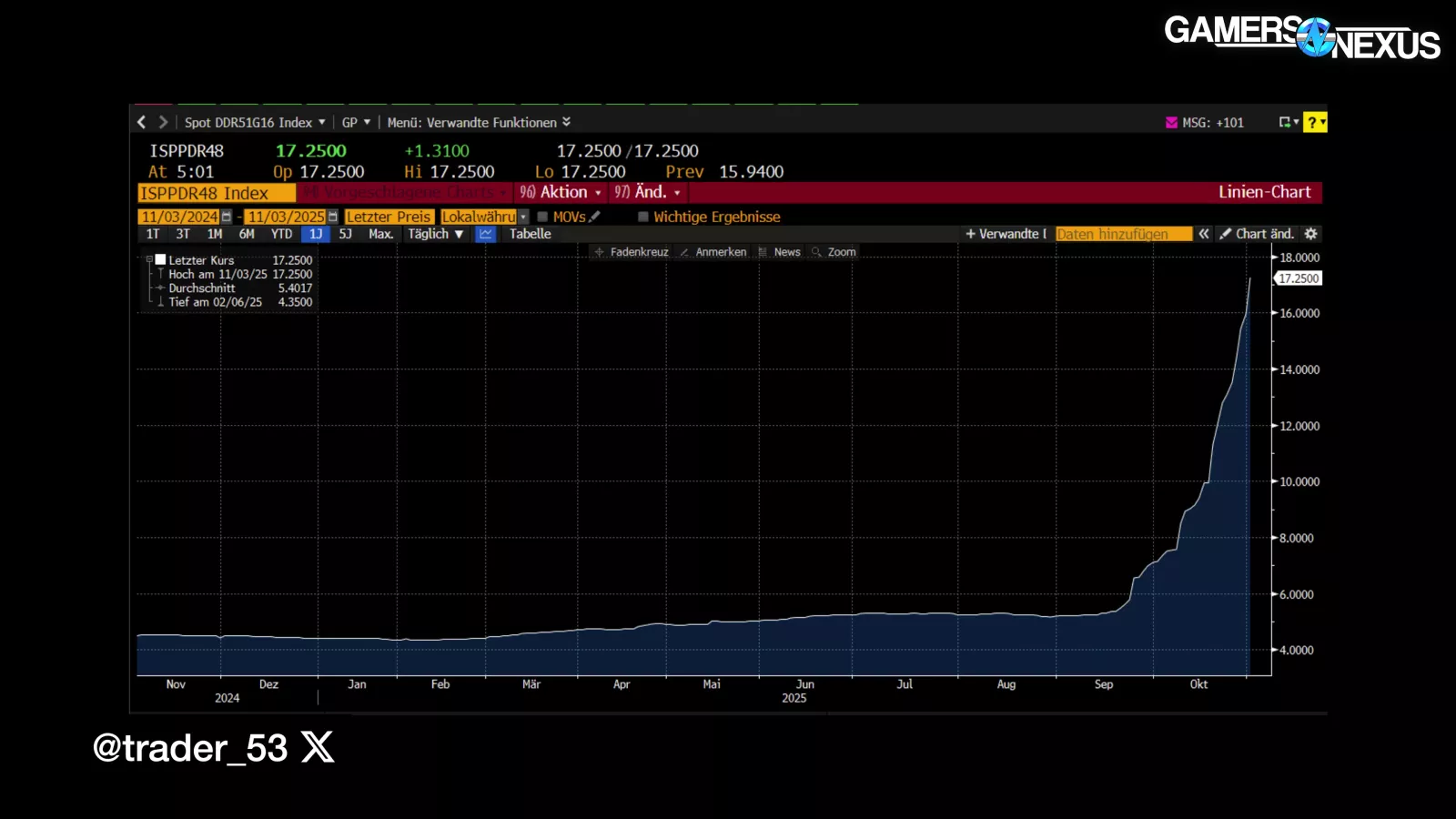

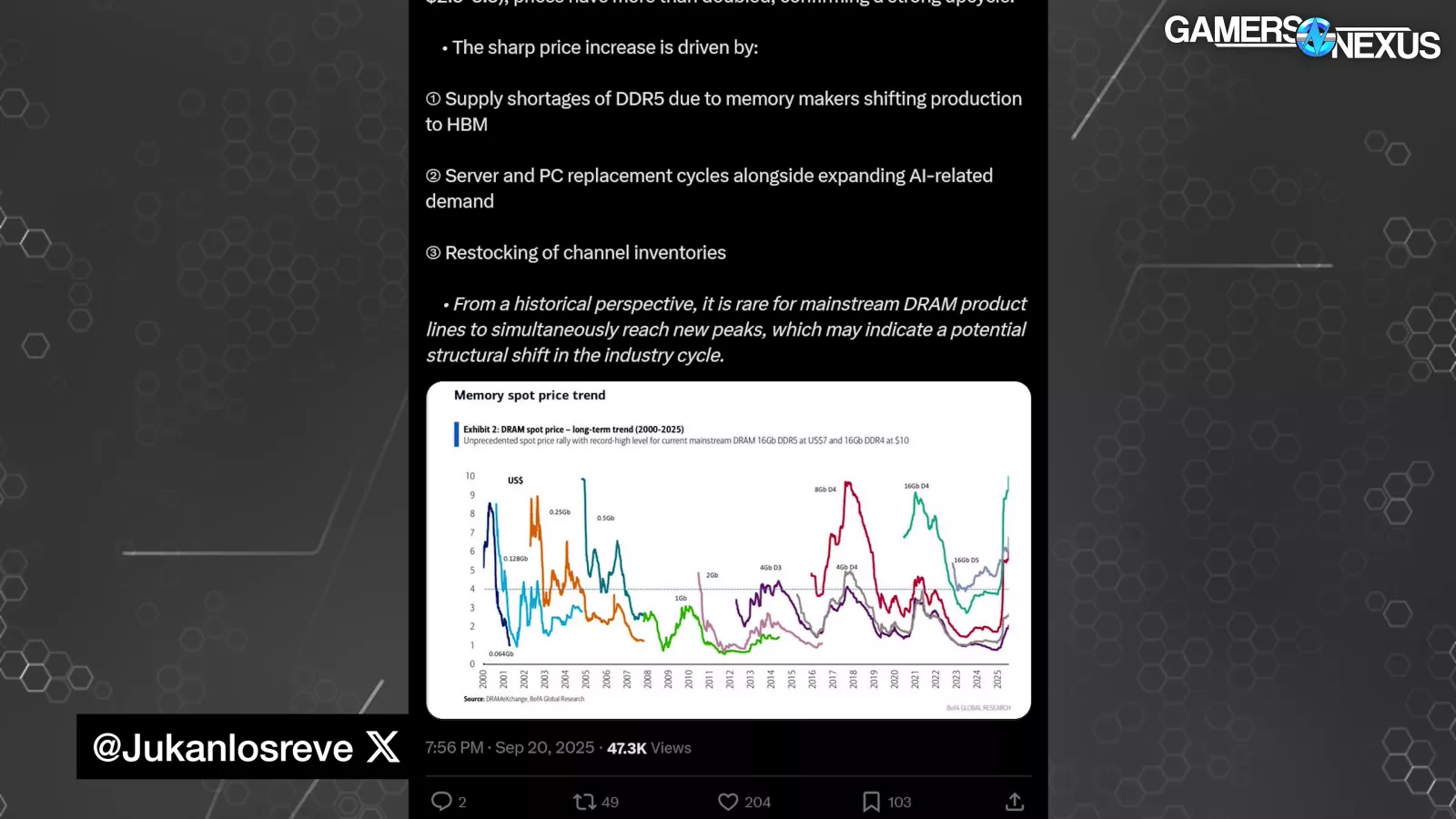

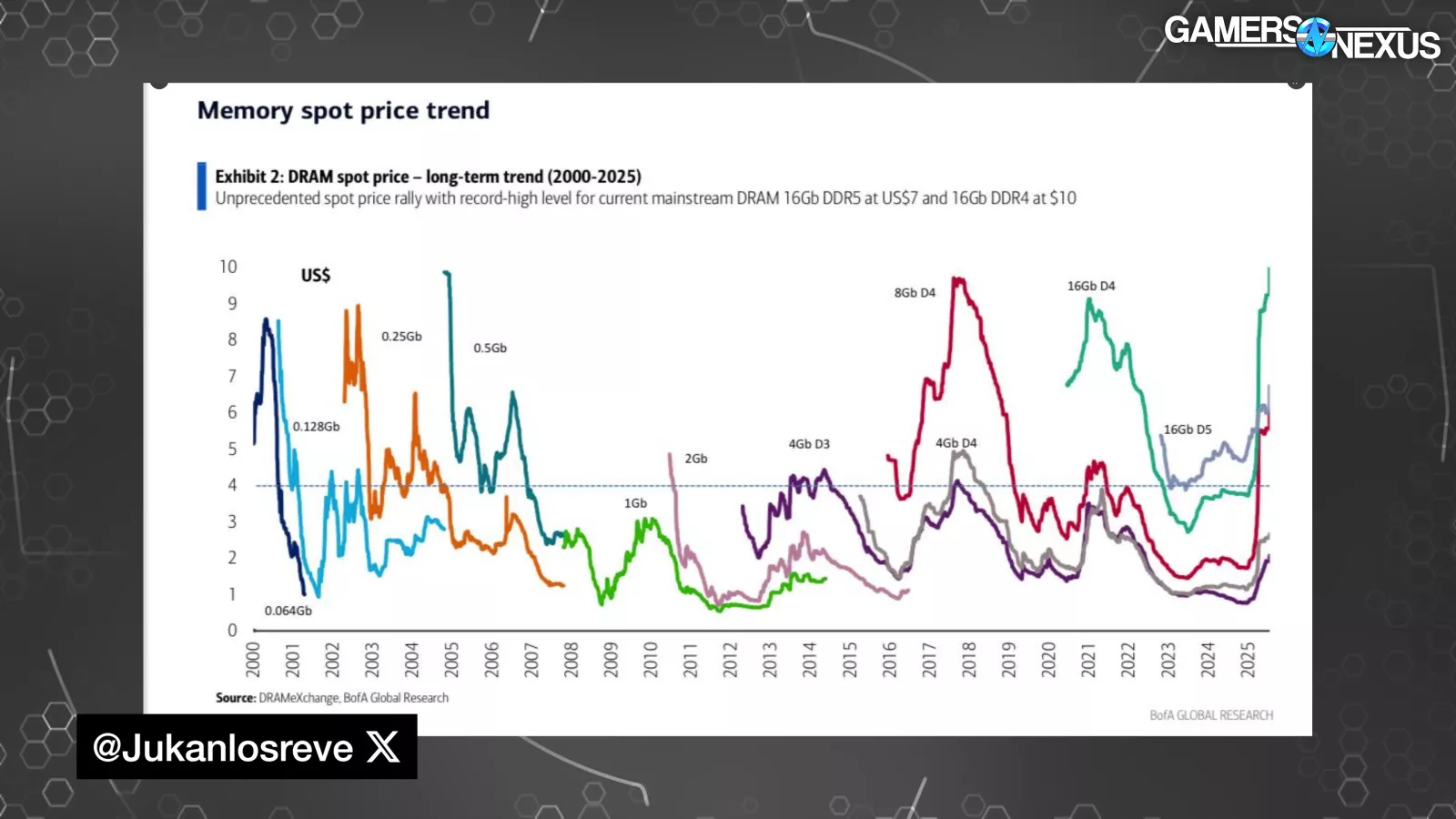

As seen in this “Long-Term Trend of DRAM Spot Prices (2000 - 2025)” graph found via Jukanlosreve on Twitter:

DRAM spot prices typically peak early in each generation’s lifetime, with highs usually between $8 and $10. This highlights DDR5 and DDR4’s EOL spot prices of $15.22 and $24.55 as outliers.

Some of this has to do with actual cost increases from higher-end technology, better process nodes, and just inflation, but we think a lot of it also has to do with the memory business learning how to fine-tune the point at which people just won’t pay more.

Shifting Dynamics

DigiTimes Asia also describes how the newfound demand is shifting dynamics between manufacturers and customers, saying, “The competition for goods is no longer among peer module makers but against Cloud Service Providers with orders of magnitude larger.”

In OpenAI’s partnership announcement with Samsung and SK Hynix, the company described plans to target “900,000 DRAM wafer starts per month,” which Tom’s Hardware notes represents around 40% of the total DRAM output, globally.

2026 Forecast

Looking ahead to next year:

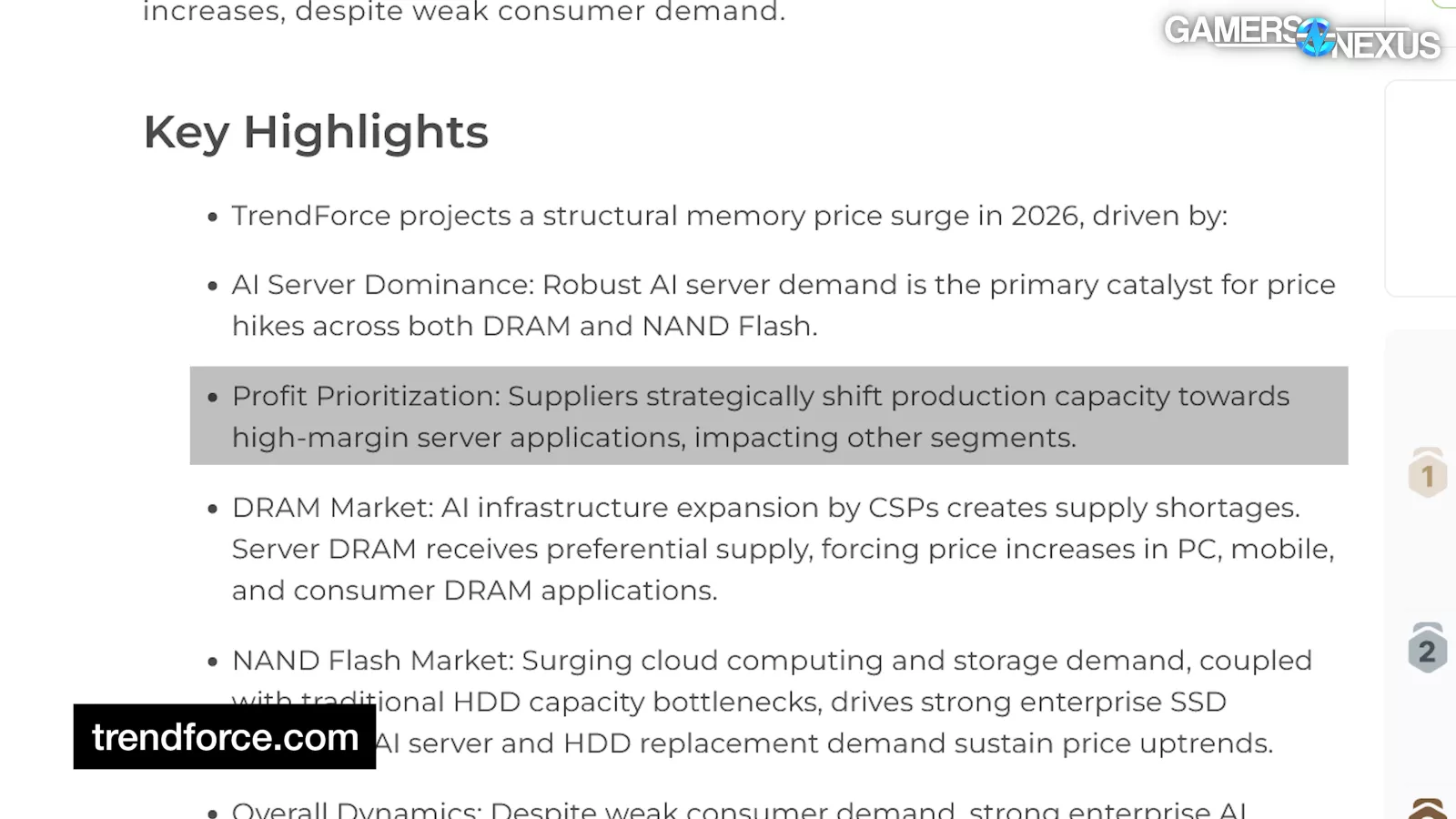

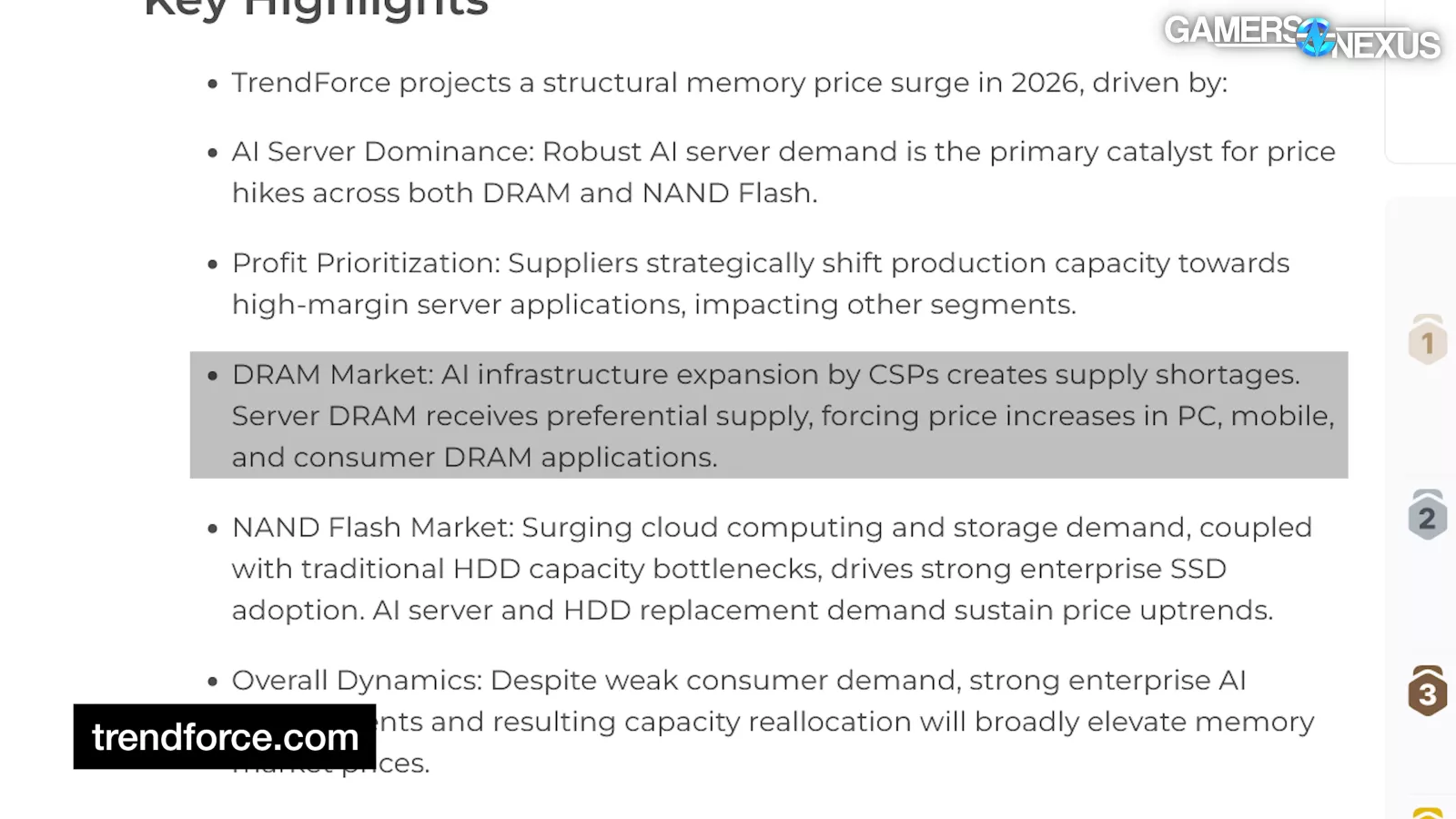

In TrendForce’s 2026 Memory Price Forecast, the company projected a “structural memory price surge in 2026,” led by:

- AI Servers, requiring large DRAM and NAND orders

- Profit Prioritization from manufacturers – shifting resources towards server applications.

Regarding the DRAM Market as a whole, the analyst firm expects, “AI infrastructure expansion by CSPs creates supply shortages. Server DRAM receives preferential supply, forcing price increases in PC, mobile, and consumer DRAM applications.”

In addition to DRAM, the company also expects AI Server and cloud computing demand to cause NAND Flash pricing to rise, reiterating the recent remarks of the head of Phison.

In October 2025, Phison CEO Pua Khein-Seng warned of severe NAND shortages to come in 2026, even claiming “I think supply will be tight for the next ten years,” citing a combination limited investment for the last few years as well as data center storage as the primary driving force.

NAND flash is used in products like solid-state drives and flash drives, anything with non-volatile storage. NAND prices and GPUs come into play here as well.

NAND Price Increases

While not directly impacted by the DRAM changes, the NAND industry is expected to undergo a similar experience, and it’s already begun.

This month alone: Sandisk raised its November contract prices by 50%, Samsung is reportedly considering 20-30% price increases for its overseas NAND supply in 2026, and Phison’s CEO stated:

NVIDIA Super Series Mention

As for video cards, they’re affected because memory is on video cards. These DRAM price increases will impact the entire PC industry.

Rumors claim that NVIDIA’s delayed its 50 Series Super refresh to Q3, as the company prioritizes its denser GDDR7 modules towards workstation GPUs, and ASUS recently warned that it may have to raise its prices to reflect the difference in RAM.

Conclusion – Best Options For Consumers

So to quickly recap: DDR4 and DDR5 pricing has nearly doubled within the past few months. AI infrastructure and cloud service providers have driven demand to unprecedented levels. Manufacturers had been cutting supply to deal with the effects from the COVID overstock, leaving them unprepared for the sudden demand.

Now, the manufacturers have begun shifting DRAM supply resources towards AI and server uses rather than desktop. It's unlikely that prices will improve in 2026. And finally, industry leaders are indicating that NAND price increases will follow in a similar fashion.

Basically, the DRAM industry is undergoing the same experience that GPUs have in the past few years. And if you’re wondering if things are going to get worse, the answer is yes. It’s probably going to get worse. This isn’t just sensational framing. It’s not good for consumers out there right now.

Businesses have realized they can utilize the hardware for AI, and whether it has any actual commercial value, it does have shareholder value as the tulips grow rampant. Data centers are willing to pay more than consumers are.

As for suppliers, they can prioritize production of the higher-margin products by taking supply resources away from desktop components, leading to a squeezed supply which inevitably raises prices. Wafer supply is limited, so if parts get allocated to data centers, those wafers inherently aren’t becoming consumer devices. NVIDIA GPUs have already been undergoing this transformation for a while now.

In terms of advice: We can’t predict the market. We’re getting into territory where buying and selling memory might as well be trading gold, and so what’s up today could be down tomorrow. For that reason, we hesitate to give any recommendation on buying or selling because there’s just no certainty here. The bottom could fall out tomorrow on the AI bubble if, for example, a company is found to be fraudulently pumping figures in a way that shakes the stock prices to the core.

That said, assuming stability and that the trajectory remains on its projected arc, it looks like it will get worse before it gets better. Factor that into your buying however you see fit. It may make sense to go used where possible.

While it’s unlikely to produce any big savings, we’d also advise looking for any strong Black Friday deals, as we think those will be the cheapest listings available for a while. Unfortunately, it comes at a time when prices just increased, so a sale still won’t get it below what it was. Overall, we expect things to get worse before they get better.