GN Special Report: Intel vs. AMD Volume - AMD Moves 93% of CPU Sales to GN Readers

Posted on

Our latest GN Special Report is looking at sales data to determine the popularity of both AMD and Intel CPUs amongst our readers, with dive-down data on average selling price, popularity by series (R5, R7, R9, or i7, i9, and so on), and Intel vs. AMD monthly sales volume. We ran a similar report in April of this year, but with Ryzen 3000 behind us, we now have a lot more data to look at. We’ll be comparing 3 full years of affiliate purchases through retail partners to analyze product popularity among the GamersNexus readers and viewers.

This year’s busy launch cadence has meant nearly non-stop CPU and GPU reviews for the past 6 months, but that also gives us a lot of renewed data to work with for market analysis. Intel’s supply troubles have been nearly a weekly news item for us throughout this year, with a few months of reprieve that soon lapsed. With Intel’s ongoing supply shortages and 10nm delays, and with its only launch being refreshes of existing parts, the company was barely present in the enthusiast segment for 2019. Even still, it’s dominating in pre-built computer sales, and ultimately, DIY enthusiast is an incredibly small portion of Intel’s total marketshare and volume. AMD, meanwhile, has had back-to-back launches in rapid succession, which have managed to dominate media coverage for the better part of this year.

Today’s coverage will look at affiliate sales data over multiple years for GamersNexus.net readers and for GamersNexus YouTube viewers. Just like last time, we need to establish some base guidelines that are important to know:

1 – We don’t represent the entire computer market. We can’t track what sales happen outside of our audience, and so mainstream consumer purchases and enterprise or business purchases will be largely unaccounted for. When we provide percentages or numbers in this content, it’s only accounting for our audience. You can’t extrapolate this data market-wide.

2 – Month-to-month sales marketshare or sales volume is not the same as total marketshare. We aren’t looking at how many global deployed systems use Intel or AMD, but rather how many of each company’s CPUs are sold each month. Even if AMD were at 100% sales volume for a few months, it’d still be very far away from saturating the global market. The Steam Hardware Survey is a better place to look for in-place data, as opposed to incoming data. The most recent report shows AMD at 20% population for Steam users, which is also going to lean more enthusiast than the global market.

3 – We have no data for enterprise, where both AMD and Intel are currently locked in a hard fight. There is other data online to support enterprise, so we won’t be talking about this.

4 – And finally, one of the most important points is that this data will likely be affected by our own recommendations. Because people come to us for reviews and recommendations, it’s likely that products which we recommend will be more popular in the data than those we don’t.

We’re rounding to the nearest whole number for this, so results will be +/- 0.5%.

AMD vs. Intel

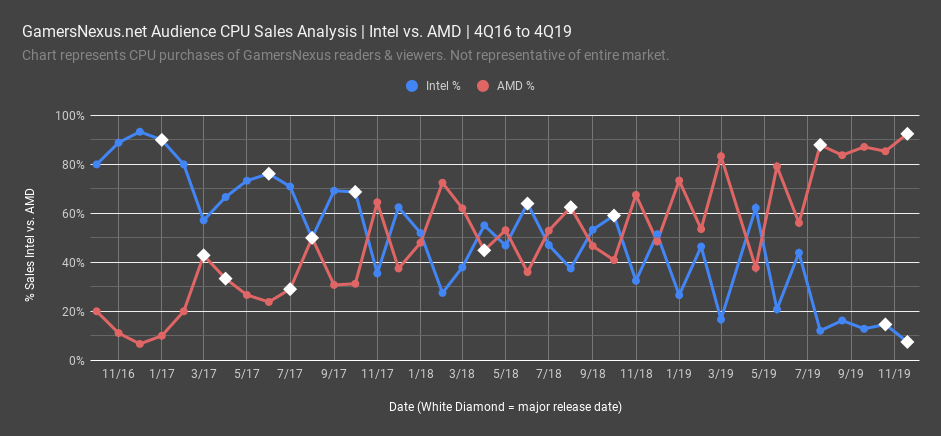

We’ll start with our year-over-year sales volume plot for AMD and Intel. This includes data from our April edition of this report, but has expanded with new data out to November 30th of 2019. We previously stopped in March.

To quickly recap, November and December of 2016 saw AMD at its lowest point in GN’s 12-year history, with Intel selling about 93% of CPUs against AMD’s 7% in those months. White diamonds, first encountered with the 7700K in January of 2017, mark major desktop CPU release dates for each company. AMD saw a surge of sales in February as old FX stock was dumped for cheap and Ryzen pre-orders began, with AMD notching a major sales month with the Ryzen 1000-series release in March.

The R5 launch sustained that for a bit, but Intel pre-orders went live for the 7000-series Extreme Edition chips in June, allowing it to recover some ground. The 8700K launched in October, burning 7700K buyers but supporting Intel at 70% sales versus AMD’s 30% of the same month. At this point, it was a fierce battle with both companies equally engaged.

Things bounced up-and-down through October of 2018, when Intel launched the 9900K and saw its last month with any meaningful hold over AMD, at about 60% sales volume for the month. After this, AMD surged to over 80% in March of 2019 – doubling its percentage stake of sales volume from March 2017 in just two years – and dipped below Intel one final time, in May of 2019, before remaining in the lead. The char tis now flipped from how it started, with AMD still clawing away large sales numbers from Intel.

The Ryzen 3000 release in July allowed AMD to move to nearing 90% for the first time in our operating history, and the November launch of the 3950X, Threadripper 3, and more importantly, Black Friday sales of other R5 and R7 chips all allowed AMD to take about 93% of sales volume for the month, with Intel down to 7% of our tracked CPU sales. This is a complete reversal from December of 2017. At present, it looks like Intel won’t have anything for at least another year, and maybe more than that, so this is likely what the chart will look like for the foreseeable future for DIY enthusiast.

AMD’s Biggest Weak Point

That chart paints a good picture for AMD, but there’s a lot more to it than that. AMD is still losing hard in the system integrator and OEM space, and while we don’t have our own numbers to track sales volume per month there, we do have people we can talk to.

Speaking with a handful of system integrators and OEMs off-record, we learned that some system integrators are still selling 70 to 80%, or more in some instances, of systems with Intel CPUs installed. Although things look grim for Intel in DIY, it still has a strong hold in pre-builts. AMD even acknowledged this in January of 2019, when it told us that its next big goal was getting closer to system integrators.

AMD is also lacking in its retail education, where traditional retailers like Best Buy lack the employee training required to adequately explain the difference between AMD and Intel systems. This is an AMD problem, and is something the company needs to address by building inroads for pre-builts and the sellers of them.

Average Selling Price

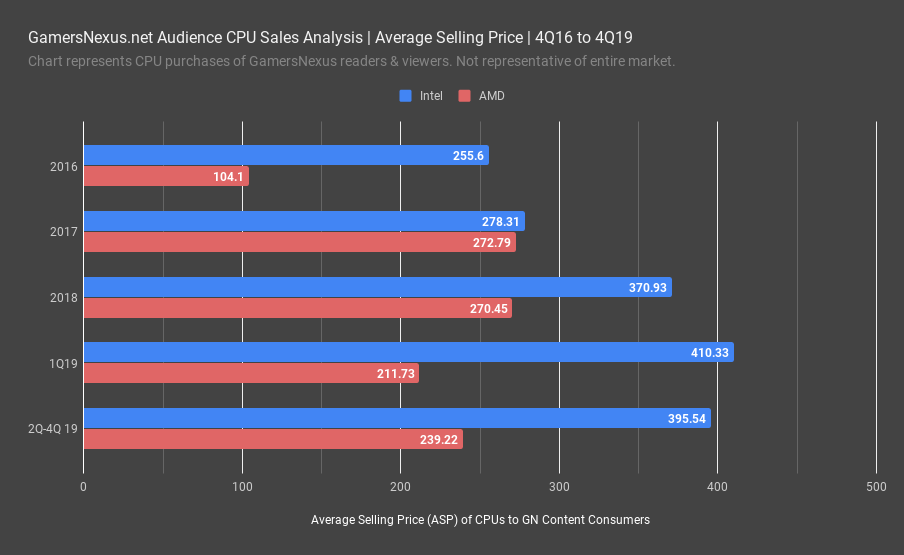

Average Selling Price is next. This is an important indicator to where each brand falls in the market, but is also an indicator as to how much revenue a company is doing. Even if the margin were the same, high ASP is appealing to investors.

For 2016, before Ryzen launched, AMD’s average selling price was just $104, which is represented mostly by firesale FX parts and by some APUs. The 2017 numbers evened-up, with Intel on the rise as Intel Core i5 CPUs were no longer considered “good enough,” allowing i7 CPUs to drive up ASP. AMD’s Ryzen launch increased its average selling price by more than 2x. 2018 continued this, with the Zen+ half-step holding AMD’s position. Intel, now with the 9900K under its belt for end-of-year and 8700K for the beginning of the year, has moved up to $371 average selling price. The entire enthusiast DIY market was shifting toward more expensive processors.

First quarter of 2019 saw a dip in ASP for AMD, mostly a result of our affiliate sales tracking so many Ryzen 1 and Ryzen 2 sales – like the 2600X and 2700X X-SKU parts, for instance. Intel continued to grow, boosting up to $410 ASP. We should note that this isn’t just a representation of trend shifts in what consumers buy, but also a shift in what Intel is able to even sell. Intel still made plenty of i5 CPUs, but with no one buying them, Intel was relegated almost entirely to the 9900K and, to some extent, the 9700K. The rest was stuck on shelves.

Finally, the new data point in this video is for quarters 2-4 of 2019. AMD moved up to $239 ASP thanks to Ryzen 3000, but was still averaged down by high sales volume of older 2000-series parts for cheap. The R5 2600, for instance, has been $115 recently. That’s great value and a good buy, but does bring averages down. Intel also fell a bit, down to $395 from its recent price reductions.

CPU by Series Sales

Time to look at some graphs of the popularity by series. This will help us understand what our GN viewers and readers are buying.

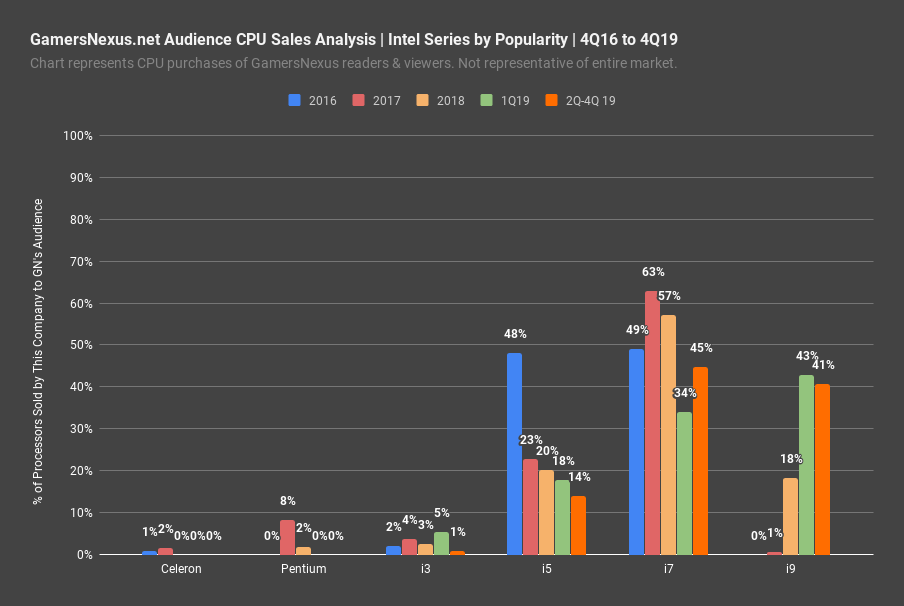

The first one is for Intel. These percentages are against the company’s total processor sales to GamersNexus viewers and readers for each year. The percentages do not factor-in the other company in either chart. The bars represent years, with the horizontal axis representing each of the processor categories by name. For Intel, the entire low-end has been lost in our audience. Pentiums, Celerons, and i3s were never too popular with our viewers – which makes sense, given the enthusiast slant – but Core i5 CPUs were big in 2016. Over the past few years, Core i5 sales have fallen from as high as 48% of Intel’s total sales to our viewers to as low as 14%. Again, that’s not 14% of total processor sales, but 14% of Intel processor sales for that year or quarter. The trend has moved heavily toward i7 and i9 CPUs, with a big uptick for i7-9700K sales for end of 2019. The i9-9900K is Intel’s strongest bastion.

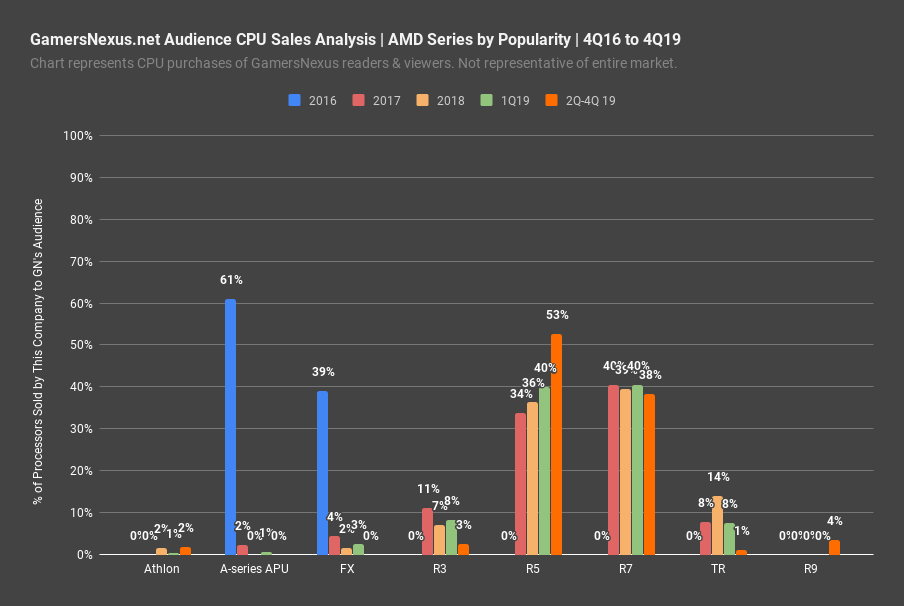

AMD’s chart is next. For this one, FX is finally dead, the R3 series is barely selling since it’s just APUs now, and the R5 series is burgeoning. Given that the R5 3600 is probably the best-balanced CPU right now, these numbers make sense. The new R9 series still comprised 4% of AMD’s processor sales for the latter three-quarters of 2019, which is a good percentage when considering the R9 CPUs are relegated to 3900X and 3950X CPUs. Threadripper hasn’t moved any volume for most of 2019, mostly because the 3960X and 3970X haven’t been available via retail yet – or not in any meaningful quantity, anyway. The R7 series has declined a bit, and we suspect that most of the purchases will split between R5 and R9 going forward, with R7 likely receding closer to the 30% mark over time.

Conclusion

Remembering that all the earlier-listed factors skew data toward the enthusiast market, our biggest takeaway is that AMD’s large uptick in performance from earlier this year was not a fluke, but rather an ongoing takeover. Intel really needs to move if it wants to compete. It has the money to compete and it has the engineers, but what Intel really needs is to slim-down on time required to execute its newer process. The company was barely present this year, with the 9900KS being an exact copy/paste of last year’s CPU, down to adding one letter to the name, and the 10980XE being functionally the same as a 7980XE from two years ago.

Intel is still holding in the i9 segment, while AMD is most dominant in the $200 price segment. The i5 is functionally dead, and R5s have taken their place. AMD’s 3900X and 3950X, while good, have had limited supply and have allowed Intel to hold more of its position than perhaps otherwise. AMD still doesn’t have a CPU that covers the gaming-only FPS-snob like Intel does, which would be another division in the market.

Editorial, Data Analysis: Steve Burke

Data Management: Ryan Greenberg

Video: Josh Svoboda, Andrew Coleman