This GN Special Report looks at years of sales data from which CPUs our viewers and readers have purchased. The focus is our audience, and so we’re looking at Intel versus AMD sales volume and, to some extent, marketshare in the enthusiast segment of GN content consumers. Our data looks at average selling price (or ASP) of CPUs, the most popular CPU models and change over a 3.5-year period, and the overall sales volume between Intel and AMD across 4Q16 to 1Q19.

AMD has undoubtedly gained marketshare over the past two years. Multiple factors have aligned for AMD, the most obvious of which is its own architectural innovation with the Zen family of processors. Secondary to this, Intel’s inability to keep up with 14nm demand has crippled its DIY processor availability, with a third hit to Intel being its unexpected and continual delays to 10nm process. It was the perfect storm for AMD: Just one of these things would have helped, but all three together have allowed the company to claw itself back from functionally zero sales volume in the DIY enthusiast space.

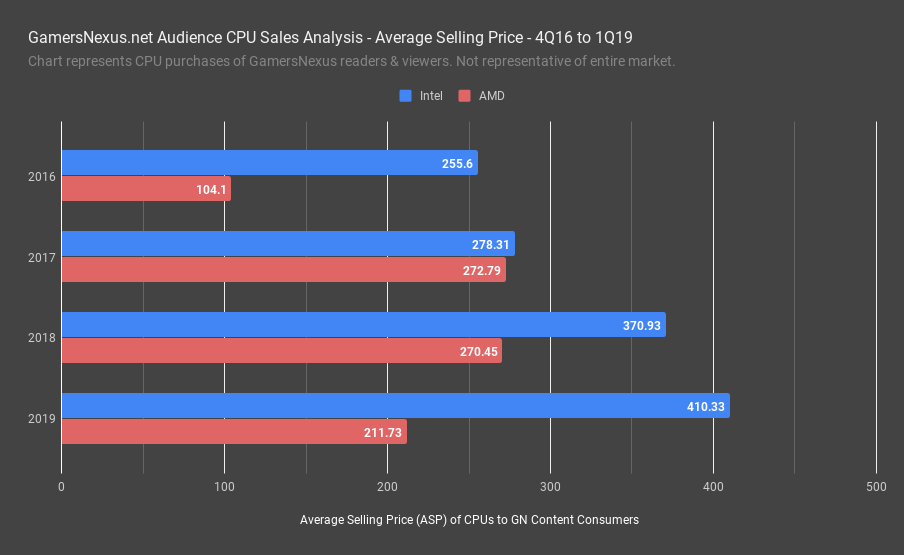

In addition to all of this, Intel’s own sales volume has tilted toward higher-end processors, pushing a higher ASP versus previous years. This is partly due to the shortage and Intel’s fab allocation to higher-end parts, but largely due to AMD’s ability to steal would-be buyers from the i5 segment into its own R5 segment.

Today, we’re looking at affiliate sales data from Newegg and Amazon over multiple years of operation, spanning both GamersNexus.net readers and our YouTube viewers. We need to set some ground rules: First, this is data that represents our audience. This means that it will be skewed in a few ways, and so it should not be extrapolated across the entire market. The OEM market, for instance, massively impacts actual marketshare, and we don’t have insight to that data. It is Intel-leaning right now, something AMD knows, but we still can’t see that data. What we can see is what you all buy, so we can look at a cross-section of the enthusiast audience to get an idea of CPU buying trends.

Secondly, note that this content will be affected by our own content and recommendations. When we posted our Best CPUs of 2018 and Best CPUs of 2017 content, our visitors were more likely to buy things we recommended than not. If we made a strong recommendation for or against a product, it would play into this content.

Let’s get into the data. Note that we are rounding to the nearest whole number to keep charts clean. Results are +/- 0.5% for rounding reasons.

AMD vs. Intel

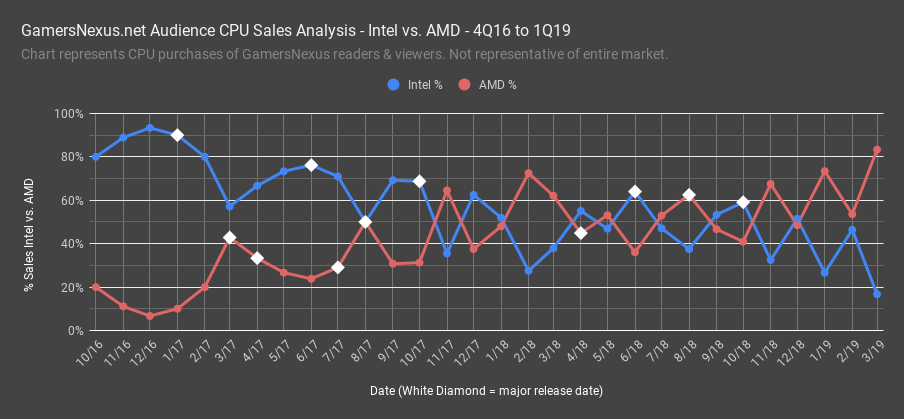

Our head-to-head data goes back to 2016, when we moved a lot of products through Newegg via GamersNexus.net, the website. Our dataset starts with Intel holding roughly 80% of monthly sales in October of 2016, with AMD at about 20%. The next several months looked bad for AMD, dipping to roughly 7% sales share in December. Nearly all units sold were going to Intel, and this was a period when AMD didn’t yet have Ryzen. The company was surviving entirely on aged FX and APU products. Things started improving on February 22nd of 2017, which is when pre-orders opened for Ryzen 1000-series CPUs. AMD climbed back to 20% in February, then spiked hard to around 43% in March. The CPUs released on March 2nd, starting with the 1700, 1700X, and 1800X. AMD started dipping again after this initial excitement eroded. This was the closest AMD had been to Intel in years.

Intel developed distance in June, when its 7900X and i9 CPUs first hit markets. Things changed again in August, with the Threadripper 1950X releasing on August 10th and the 1900X releasing end of month, alongside Intel’s i9-7980XE. The 7980XE wasn’t enough to resist AMD’s advances, though, and the two companies hit parity for the first time in GN’s tracked sales history, dating back to about 2011. AMD and Intel both moved an equal amount of CPUs. At this point, the R5 CPUs are also on the market, launching the stranglehold AMD would eventually begin to develop on the mid-range market.

This is where it really becomes a war between the two companies. CPUs started launching faster than ever, with 2017 becoming our busiest year of CPU reviews in history. Intel pulled-in all of its launch dates in 2017, bringing the i9 HEDT CPUs to June from end-of-year and rushing i5 and i7 8000-series CPU launches by a full quarter; in fact, it was so rushed that only the Z370 motherboards were immediately available, and even those didn’t have high quantities available. The CPUs were tough to find and mainstream chipsets didn’t launch with the non-K CPUs, illustrating Intel’s rush to get CPUs to market before the holiday.

Intel announced the 8000-series CPUs in September and launched them in October of 2017. Unfortunately for Intel, as Black Friday rolled around, the company got steamrolled in sales volume. Intel moved just under 40% of our total tracked sales volume, with AMD stretching past 60%.

Ryzen 3 and 5 had launched in July, Threadripper in August, and R7 in March, so this was when the full product stack was on the market. We reported on several CPU and motherboard combo deals for AMD in November, but we did post PC build guides for both Intel and AMD systems – Intel almost never has sales, though, even on old stock, and so AMD easily commanded this holiday buying season. November had very high sales volume for both companies, but AMD won for both November.

2018 started with rough parity, with AMD launching the APUs in January and February and Intel launching its new chipsets. The next major release date was the 2700X in April of 2018. Up until this point, sales pushed higher for AMD, marked primarily by constant sales on the 1000-series Ryzen CPUs. The strategy of dumping old stock worked well: Because the motherboard socket is the same, users could reasonably be convinced to buy an older Ryzen CPU on sale, kinks now mostly worked out in BIOS, and then upgrade later. This allows AMD to develop a market for its new CPUs and fray the edges of Intel’s marketshare. June saw Intel pushing past AMD, where we saw high volume of i7 sales with stock finally coming back to market.

The 9000-series helped Intel regain volume in September and October, but AMD again won Black Friday, and by a large margin. We first reported Intel’s 14nm shortage looming in July of 2018, and by November, that became a known issue. Into 2019, Intel’s CPU supply has tilted heavily to system integrators and OEMs, allowing the DIY market to partly dry-up and allowing prices to rise.

Finally, in March of 2019, the chart flipped to the inverse of the beginning of the chart. With high combined sales volume between the two, AMD held over 80% of total sales to our viewers in March. AMD now firmly leads Intel in our charts, although average selling price helps Intel maintain similar total revenue through our viewers and readers.

Average Selling Price

The next metric to consider is the average selling price. Despite a dip in sales that has allowed AMD to post more units moved per month in some instances, Intel has managed to keep relatively close in total revenue generated with fewer sales. In 2016, our viewers typically bought Intel CPUs averaging $256 spend, with the rarer AMD purchases sticking closer to $104. Most of these were FX CPUs that were hitting the bargain bin. 2017 saw ASP increase to $278 for Intel CPUs among our audience, with more users trending toward i7 SKUs, with AMD jumping to $273 with the launch of Ryzen, particularly the more expensive R7 series. 2018 saw AMD holding steady at around $270 ASP, with Intel massively jumping, even with large datasets, all the way to $371 ASP. This isn’t just from gradual price increases as new CPUs have come out, but also because Intel purchases have trended away from the Core i5, which was popular in 2016, and toward the i7. That’s because AMD is beginning to grab more of the i5 market with its R5 CPUs, forcing Intel’s ASP up as more users go for either an R5 or an i7 or i9. 2019-to-date has Intel trending at $410 ASP, with AMD thus far at $212. This is a result of continual shortages for Intel and increasing popularity of the 9900K, while AMD’s has dropped from the still ongoing sales of Ryzen CPUs.

CPU by Series Sales Data

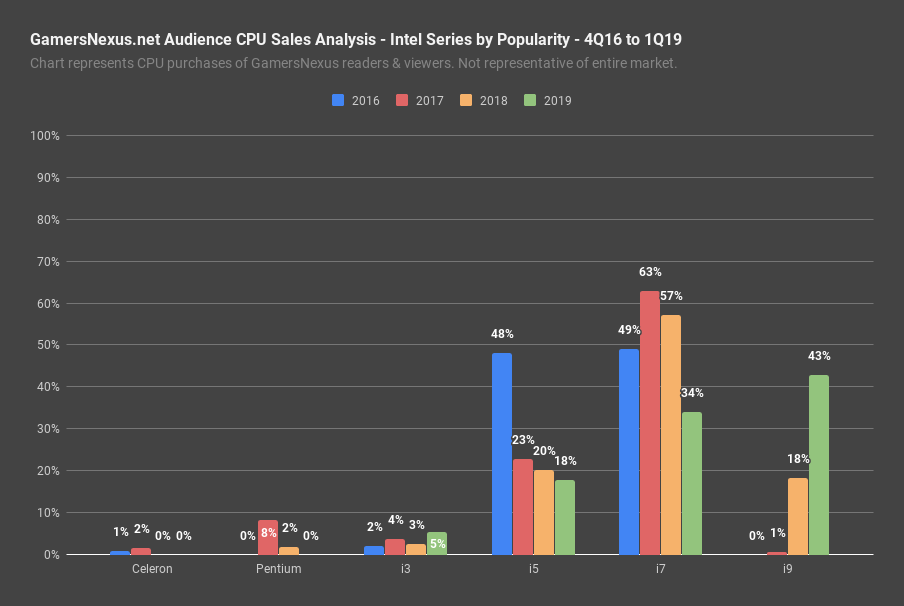

CPU series choices have also shifted over the years. For the last quarter of 2016, the i5 CPUs did notably well, combining with the i7s to make up nearly all sales for Intel in 4Q16. This was 6600K era, which is back when both i5 and i7 CPUs were 4C solutions. This was also when most of us were saying “an i5 is enough for gaming,” so it makes sense to see this split. 2017 changed that to lean more heavily toward the i7, aligning with the 7700K. The i5 still remained popular, and the Pentium series gained popularity in the low-end market by undercutting some of AMD’s solutions. Where we really saw the shift was in 2018, where processor shortages and shifting focus to the high-end resulted in the creation of a new market in the i9 segment, particularly with the 9900K. 2019 further solidifies the reduction in i5 sales as i9 moved to take the place of i5 and i7 popularity.

Again, this is for a few reasons: One is the CPU shortage and Intel’s shifting of processor inventory toward system integrators, but the larger change is that AMD has taken most media recommendations for the mid-range market. At GN, we typically recommend an R5 over an i5 in most use cases, and we’re not alone. If people buy Intel, it’s trending toward higher-end, more expensive parts by the company, whereas AMD has a wider spread across mid-range parts selection.

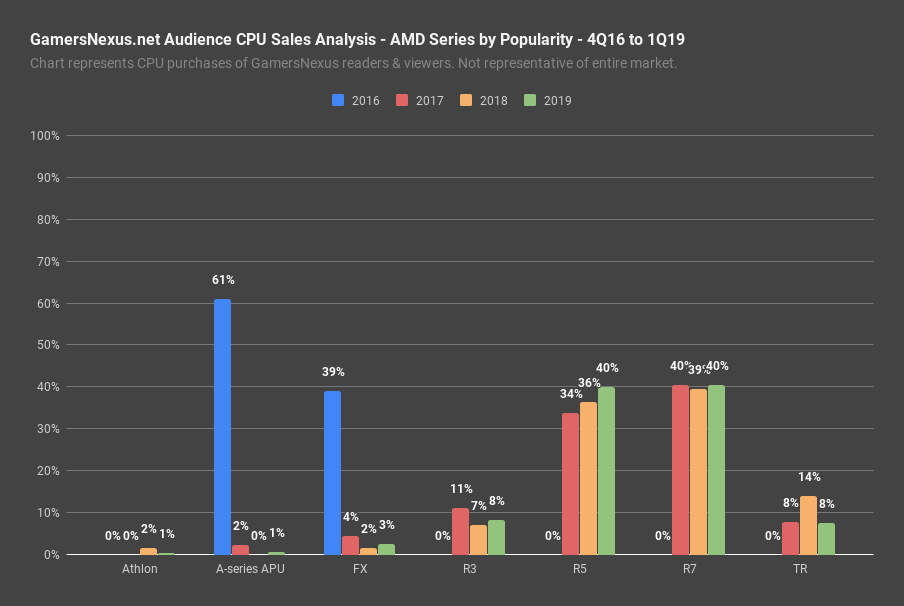

The AMD chart shows the limited selection in 2016: We primarily reviewed the APUs from AMD that year, and so it makes sense that A10 purchases were high. Most of the visitors landing on AMD CPU reviews on our site were reading about APU performance, and so were more likely to purchase an APU. Either way, it’s not like much else was available outside of FX or an APU. In 2017, we saw the split most heavily favor the R7 CPUs, at over 40% total AMD sales volume, with the R5 ranked next-highest at over 30%. The R3 held about 11-12% sales volume, with Threadripper making-up about 8% of sales volume for AMD. FX had a surprisingly high distribution in 2017, but was on the way out. This distribution of R7 to R5 is fairly healthy, and across the entire stack, we get a predictable scatter of samples. AMD did well to push more units at its high-end. This continued into 2018, except that the R5 captured more sales from the R7 CPUs and dying FX CPUs. The R3 CPUs trended down, as they became more focused on Raven Ridge, and Threadripper posted strong numbers from another release and constant sales on the 1950X and 1920X. 2019 has shown a more even split between the R5 and R7, pulling marketshare away from Intel’s i5 segment.

Conclusion

As a reminder for those who shamelessly skipped the article until now, this data is based upon our viewers and readers. A few factors skew the data versus the reality of the actual market, which we have no complete insight to. One of them is that our viewers and readers are very likely enthusiasts, and so these buyers are more likely to be at the cutting edge, more likely to spend more, and more likely to try new architectures without hesitation (unlike, say, a massive enterprise operation). We also skew the data by nature of producing review content: If we review a CPU positively, like the R7 2700, or we give a CPU a ton of livestream overclocking coverage, like Intel's i9 CPUs, it is likely that we are influencing buying trends in our audience. The data is therefore imperfect and cannot be extrapolated outside of our space in the market, but is interesting nonetheless. Note further that our data in 2016 is limited to mostly APU reviews and a few other CPUs, so the chance of an APU purchase from a user landing on our site was very high.

AMD is really picking up steam with our audience. Intel needs to get more CPUs out the door, but also needs to strengthen its mid-range product offerings. AMD’s higher product availability and overall better offerings in the R5/i5 segment allow it to establish a stronghold in the enthusiast market. The longer Intel sacrifices this market, the lower its sales volume will be. Intel is pushing into higher-priced, higher-end processors, and has largely forsaken its i5 CPUs. ASP has gone up as a result, and so Intel can keep up with AMD in total revenue, but AMD is seeing a higher moving volume among our viewers and readers. This will eventually bite Intel, as it means wider-spread software support and more focused hardware partner efforts that could favor AMD products.

Editorial: Steve Burke

Additional Research: Ryan Greenberg

Video: Josh Svoboda, Andrew Coleman